Each month we sort through over 1,000 dividend paying stocks to create a top 100 list based on critical dividend factors. These include yield, payout ratio, dividend growth, revenue growth, and 1-year return.

This list highlights the 5 highest yielding stocks from our top 100 list. Data in the below chart is from our January 1 data refresh. The charts are 6-month charts from CNBC.

| Name | Symbol | P/E | Yield | 5yr Div Growth % | 3yr Rev Growth % | Payout Ratio | 1 Year Return % | Rating |

|---|---|---|---|---|---|---|---|---|

| AT&T Inc | T | 5.41 | 7.03 | 2.16 | 6.62 | 38.02 | -22.26 | 88 |

| Evolution Petro | EPM | 9.96 | 5.74 | -- | 14.03 | 53.57 | 4.54 | 87 |

| Keurig Dr Pepper | KDP | 4.29 | 5.16 | 11.27 | 3.01 | 22.13 | 34.06 | 88 |

| Macy's Inc | M | 5.45 | 5.03 | 13.55 | -4.04 | 27.4 | 22.59 | 89 |

| United Bankshares | UBSI | 15.54 | 4.41 | 1.41 | 15.32 | 68.45 | -8.57 | 88 |

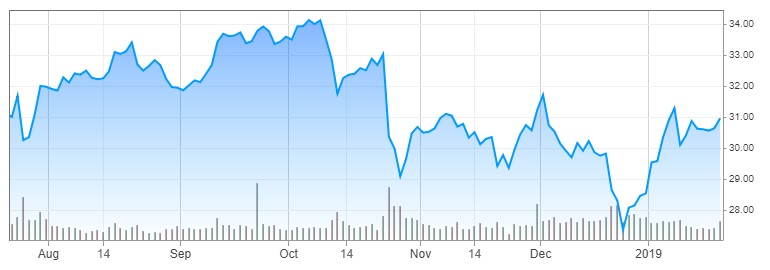

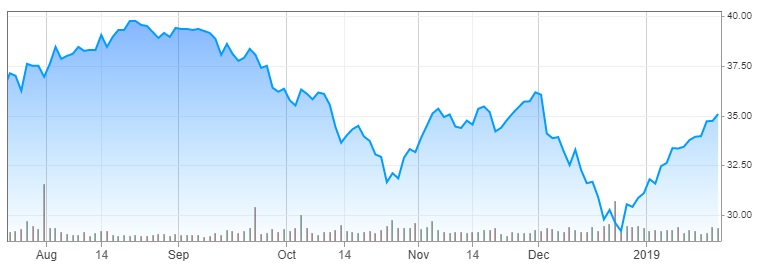

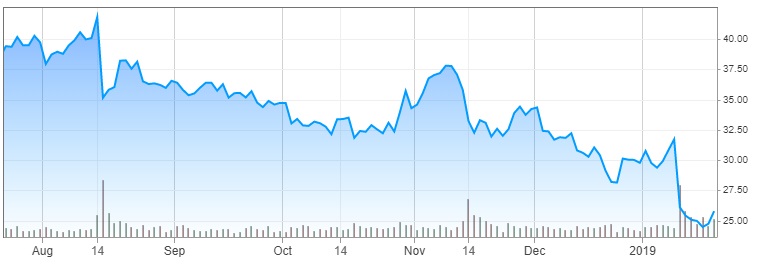

AT&T Inc (T)

AT&T has a P/E ratio of 5.4 and a dividend yield of 7%. It has a moderate 5-year dividend growth rate of just over 2% with a decent 6.6% 3-year revenue growth rate and a low payout ratio of 38%. The negative return hurt AT&Ts rating.

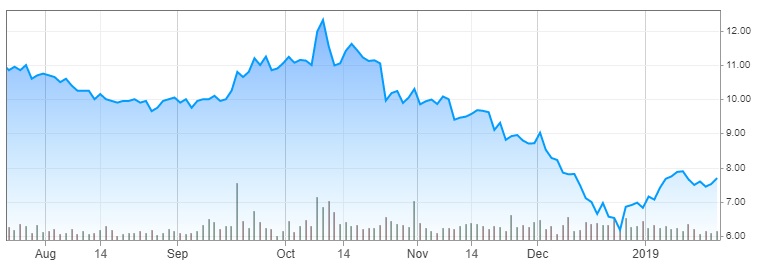

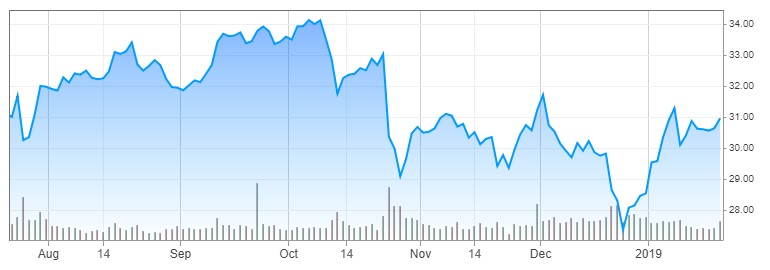

Evolution Petroleum (EPM)

Evolution Petroleum has a yield of 5.7% and a 3-year revenue growth rate of 14%. It has a one year return of 4.5%.

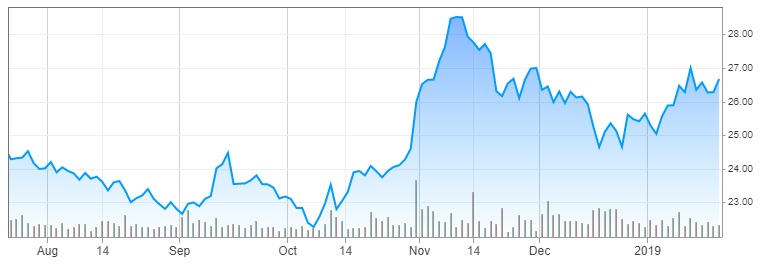

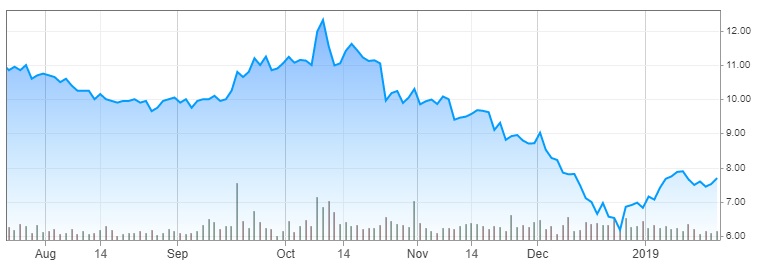

Keurig Dr Pepper (KDP)

Keurig Dr Pepper has a P/E of 4.3 and a yield of 5.16%. It has a strong 5-year dividend growth rate of 11.2% and a poor 3-year revenue growth rate of 3%. It has a low payout ratio and a solid 1-year return of 34%.

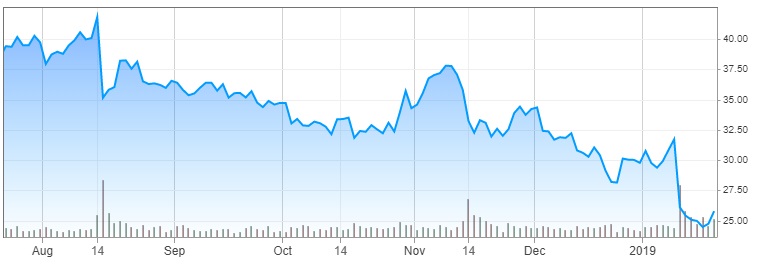

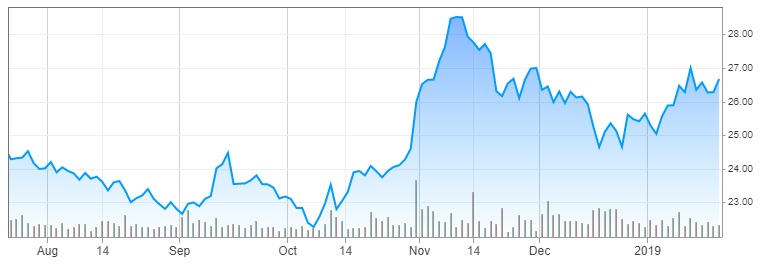

Macy’s Inc (M)

Macy’s Inc has a P/E ratio of just 5.4 and a dividend yield of 5%. It has a strong 5-year dividend growth rate but there is some concern over their negative 3-year revenue growth rate of -4%. It has a low payout ratio and a strong 22% 1-year return.

United Bankshares (UBSI)

United Bankshares INC has a dividend yield of 4.4% and a payout ratio of 15.5. It has a low 1.4% 5-year dividend growth rate but a very strong 15.3% 3-year revenue growth rate. The payout ratio is fine at 68% but it has had a poor 12-month performance.

AT&T Inc (T)

AT&T has a P/E ratio of 5.4 and a dividend yield of 7%. It has a moderate 5-year dividend growth rate of just over 2% with a decent 6.6% 3-year revenue growth rate and a low payout ratio of 38%. The negative return hurt AT&Ts rating.

Evolution Petroleum (EPM)

Evolution Petroleum has a yield of 5.7% and a 3-year revenue growth rate of 14%. It has a one year return of 4.5%.

Keurig Dr Pepper (KDP)

Keurig Dr Pepper has a P/E of 4.3 and a yield of 5.16%. It has a strong 5-year dividend growth rate of 11.2% and a poor 3-year revenue growth rate of 3%. It has a low payout ratio and a solid 1-year return of 34%.

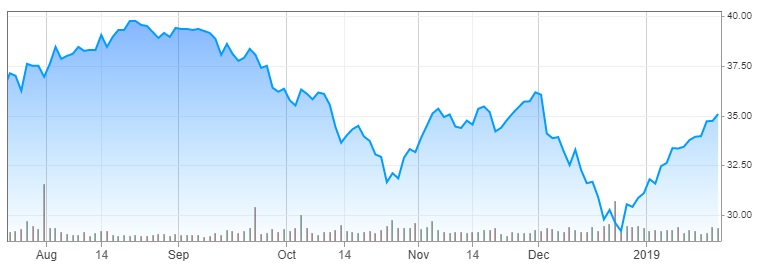

Macy’s Inc (M)

Macy’s Inc has a P/E ratio of just 5.4 and a dividend yield of 5%. It has a strong 5-year dividend growth rate but there is some concern over their negative 3-year revenue growth rate of -4%. It has a low payout ratio and a strong 22% 1-year return.

United Bankshares (UBSI)

United Bankshares INC has a dividend yield of 4.4% and a payout ratio of 15.5. It has a low 1.4% 5-year dividend growth rate but a very strong 15.3% 3-year revenue growth rate. The payout ratio is fine at 68% but it has had a poor 12-month performance.