Emerson Electric Co. (EMR) stands as a paragon of industrial innovation and resilience, headquartered in Ferguson, Missouri. This diversified global manufacturing and technology company specializes in offering a wide array of engineering services and solutions in the automation, commercial, and residential solutions sectors. Emerson’s commitment to sustainability, innovation, and operational excellence has not only secured its position as a leader in the industrial sphere but also fostered a robust financial backbone that supports its strategic growth initiatives.

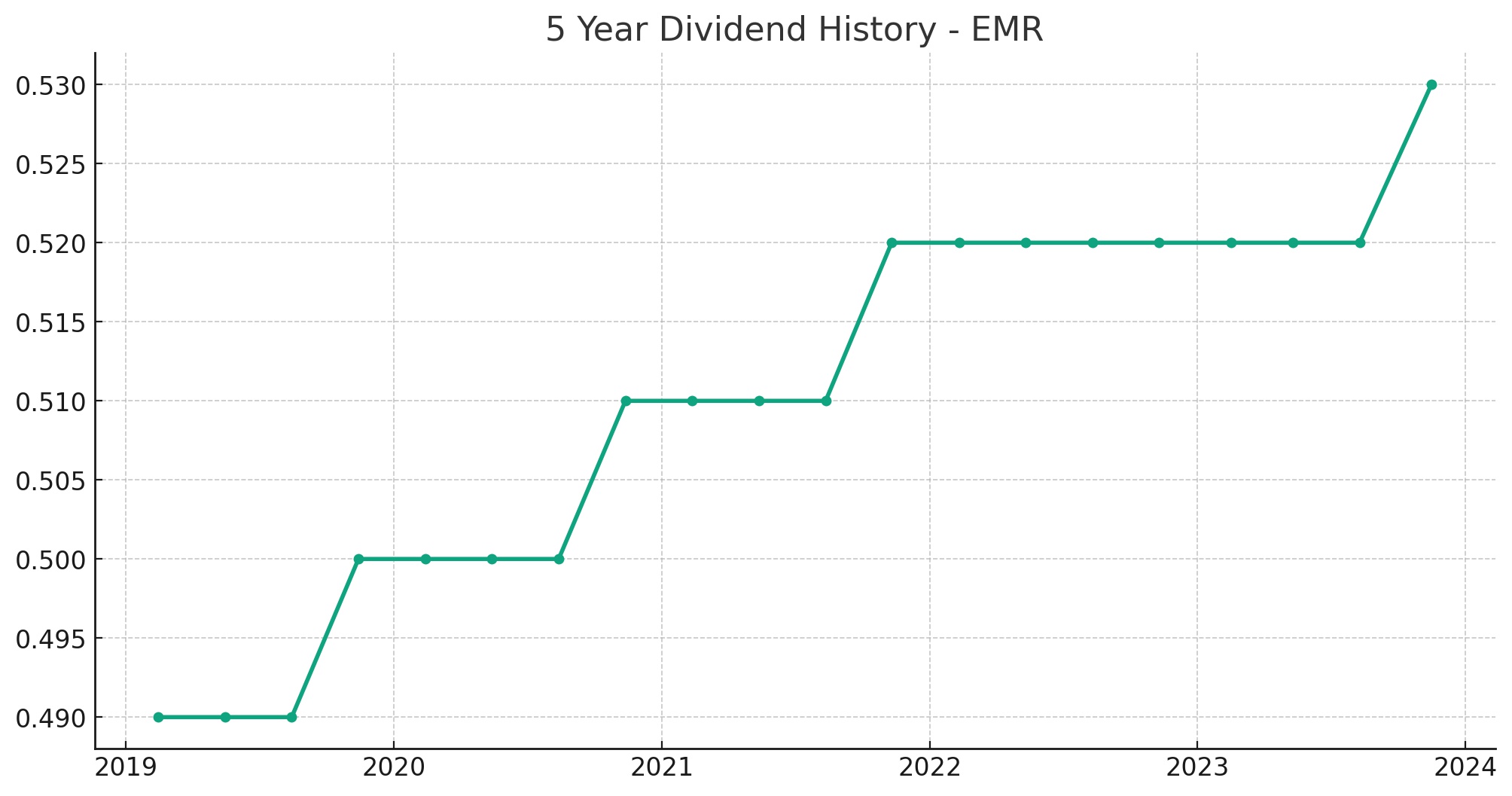

A testament to its financial strength and shareholder value proposition is Emerson’s remarkable achievement of increasing its dividend for 65 consecutive years, making it an esteemed member of the Dividend Kings. This elite group is reserved for companies with a half-century legacy of consecutive dividend growth, underscoring Emerson’s consistent performance and the reliability of its dividend policy. This achievement reflects not just Emerson’s enduring commitment to returning value to its shareholders but also signifies its operational success and the adaptability of its business model in the face of changing economic landscapes and market demands.

Analyst Ratings

- Brett Linzey at Mizuho upgraded the rating from Hold to Strong Buy with a price target of $118, indicating a potential upside of +26.34% on January 4, 2024.

- Joseph O’Dea from Wells Fargo maintained a Buy rating, raising the price target from $100 to $120, suggesting a +28.48% upside on December 19, 2023.

- Chris Snyder at UBS held a consistent rating but adjusted the price target from $104 down to $95, forecasting a modest +1.71% gain on November 22, 2023.

- Tommy Moll of Stephens & Co. continued with a Buy rating, albeit lowering the price target from $120 to $105, which implies a +12.42% upside on November 10, 2023.

- Deane Dray from RBC Capital kept a Buy stance, with the price target slightly decreasing from $109 to $106, translating to a +13.49% potential increase on November 8, 2023.

- Andrew Kaplowitz of Citigroup sustained a Strong Buy rating, adjusting the price target from $112 to $109, indicating a +16.70% upside also on November 8, 2023.

- Chris Snyder of UBS downgraded the rating from Strong Buy to Hold, with a revised price target from $97 to $104, showing a +11.35% gain on October 3, 2023.

- Ken Newman at Keybanc initiated coverage with a Buy rating and a price target of $120, foreseeing a +28.48% upside on October 3, 2023.

- Jeffrey Sprague from Vertical Research upgraded the stock from Hold to Strong Buy with a price target of $120, hinting at a +28.48% potential increase on September 15, 2023.

Insider Trading

Over the last 6-12 months, insider transactions for Emerson Electric Co. (EMR) display a mix of strategic purchases and sales, reflecting varied confidence levels among the company’s top brass. Notably, Surendralal Lanca Karsanbhai, the CEO, made a bullish move by purchasing 10,000 shares at $88.1963 each on November 17, 2023, significantly increasing his holdings and showcasing a strong belief in the company’s future prospects. This purchase was complemented by several other buys from insiders like Joshua B Bolten and James Morgan Mckelvey Jr., who also chose to invest in EMR, albeit on a smaller scale, suggesting a shared optimism within the executive suite.

On the flip side, the transaction narrative isn’t without its cautionary tales. Ram R Krishnan, COO, opted to lighten his load by selling 12,500 shares at $96.0890 each on December 15, 2023, possibly to diversify or realize gains. Similarly, Lisa Flavin, CCO, engaged in a notable sale post-exercise in September, further diluting her position. These sales, while part of typical executive compensation management, might signal a variety of strategic decisions or personal portfolio adjustments rather than a direct commentary on the company’s valuation. Amidst this financial choreography, the insider activity within EMR paints a picture of cautious optimism, with key figures betting on the company’s continued success while also taking steps to secure personal financial goals.

Dividend Metrics

Emerson Electric Co. (EMR) boasts a venerable history of increasing dividends, stretching a remarkable 65 years and placing it among the venerable ranks of Dividend Kings, a testimony to its enduring commitment to shareholder returns. The company presents a current dividend yield of 2.22%, which, while robust, falls slightly below its 5-year average yield of 2.57%. This suggests that either EMR’s stock price has been climbing faster than its dividend growth or that the dividend increases have been modest—just 1.37% over the last five years.

The revenue growth over the past year stands at a healthy 5.10%, indicating a firm’s effective strategy in generating sales amidst variable market conditions. With a payout ratio of 55%, Emerson Electric retains nearly half of its earnings for reinvestment into the company, striking a balance between rewarding shareholders and funding future growth. Despite the modest 1-year return of 3.42%, the company’s steady performance in dividends may attract investors looking for consistent income over potential high-growth, high-risk returns.

Dividend Value

Emerson Electric Co. (EMR) presents an interesting case when its current dividend yield of 2.22% is held up against its 5-year average of 2.57%. This suggests that the stock’s yield has compressed slightly in the context of its historical performance, potentially hinting at a higher stock price relative to dividend payouts in recent times.

For yield-focused investors, this compression might signal a less attractive entry point compared to historical norms, assuming they are looking for yields that meet or exceed the 5-year average. However, this could also be interpreted as a marker of investor confidence, with the price appreciating on the back of solid company fundamentals or future earnings prospects. The yield’s dip below the longer-term average may also suggest that the market has already priced in expectations of continued operational strength that could support sustained or increasing dividend distributions in the future.

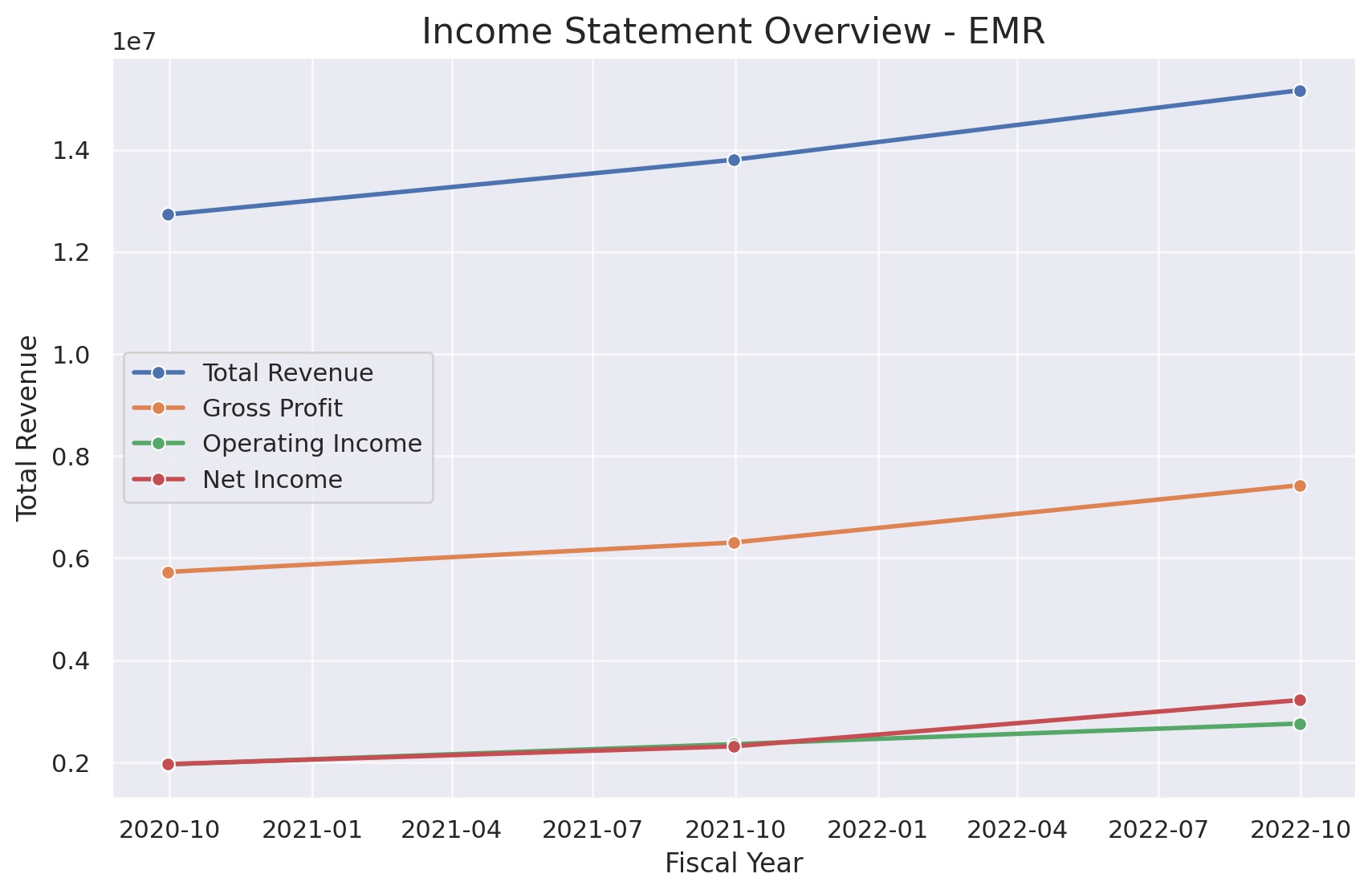

Income statement Analysis

As the fiscal year drew its curtains, the income statement for the trailing twelve months through September 30, 2023, reveals a performance where total revenue held steady like a metronome at $15,165,000, not budging an inch from the previous year. The cost of revenue, playing second fiddle, stayed equally unchanged at $7,738,000. In a surprising twist, the gross profit decided not to venture out from its comfort zone either, marking the same figure as last year at $7,427,000. It seems as if the numbers got together and decided that they liked the previous year’s performance so much, they’d give an encore.

In the land of operating expenses, the figures took a leaf out of the gross profit’s book, staying pat at $4,668,000, ensuring that operating income could echo the past at $2,759,000. Down the statement, the plot thickens—or rather, doesn’t—with net income common stockholders pulling a Houdini and dramatically increasing to $13,219,000, a significant leap from the preceding years, as if they’d discovered a fiscal fountain of youth. This leap left basic and diluted EPS in awe, at a healthy 23.00 and 22.88, respectively, making one wonder if the company’s accountants had discovered alchemy. Despite the magic in net income, the rest of the statement held a predictable line, suggesting a script where the lead actor steals the show while the supporting cast maintains the status quo.

Balance sheet Analysis

The balance sheet of the trailing twelve months through September 30, 2023, reads like a financial fairy tale with total assets mushrooming to an impressive $42,746,000 from a humble $22,882,000 back in 2020. It’s as though the assets, not content to simply grow organically, decided to take a dose of fiscal fertilizer. This growth spurt has stretched the gap between assets and liabilities to a comfortable $26,598,000 in total equity, suggesting that the company’s net worth is not just healthy but has been hitting the financial gym.

Liabilities, on the other hand, seem to have been on a diet, trimming down from their 2022 figure of $19,356,000 to a more svelte $16,148,000. The company’s accountants might be giving each other high-fives over this reduction, as it indicates a lighter load on the company’s shoulders. Meanwhile, net tangible assets appear to have taken a curious turn, going from negative $10,154,000 to slightly less negative at -$54,000, perhaps hinting at an accounting enigma or a valuation riddle. This quirk aside, working capital and total debt paint a picture of a company that is managing its finances with an eye towards agility and efficiency, keeping the balance sheet’s ship steady as it sails the tumultuous seas of the market.

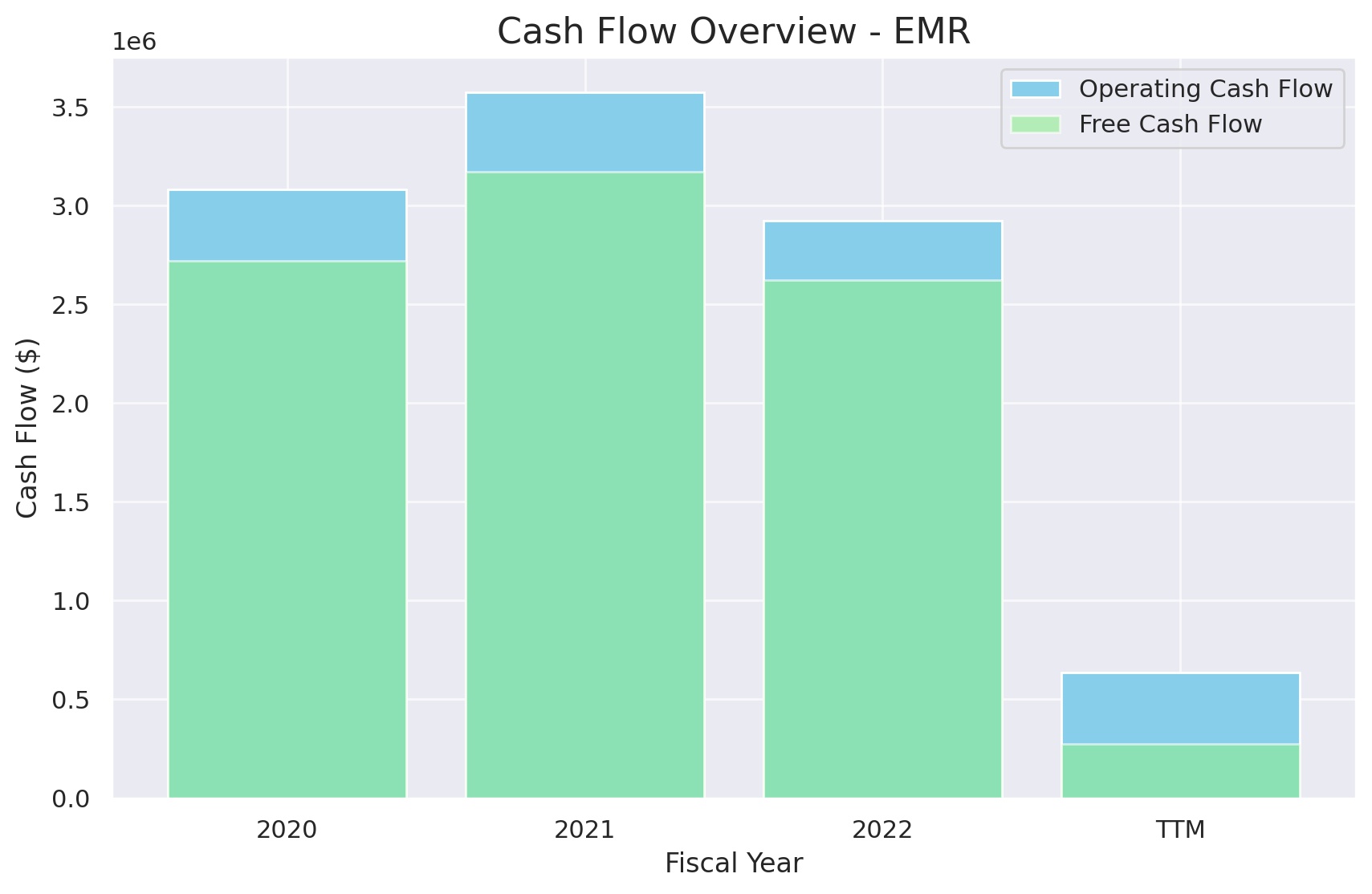

Cash Flow Statement Analysis

The cash flow statement for the trailing twelve months through September 30, 2023, presents a tableau of financial ebb and flow with a touch of whimsy. Operating cash flow, seemingly content with its previous performance, opted for a repeat and parked itself at $637,000, a far cry from the more robust $3,083,000 witnessed back in 2020. It seems that in the grand theater of finance, operating cash flow has decided to play a more understated role this fiscal year.

Investing cash flow, in a curious twist of fate, transformed from a significant outflow of $-5,334,000 in 2021 to a staggering inflow of $12,415,000. This dramatic turnaround could be the envy of any investor who has ever dreamed of such a reversal of fortunes. Financing cash flow, not to be outdone in the drama department, swung from a supportive $2,048,000 inflow to an exodus of $-6,823,000, as if it suddenly developed an urge to be free from the constraints of the balance sheet. This financial choreography resulted in an end cash position of $8,051,000, a respectable finale to the fiscal ballet, suggesting that despite the unpredictable pirouettes of cash flows, the company has managed to land gracefully on its feet.

SWOT Analysis

A SWOT analysis for Emerson Electric Co. (EMR) would identify the company’s internal strengths and weaknesses, as well as the external opportunities and threats it faces:

Strengths:

- Established Market Position: EMR has a strong presence in its industry, with a long history and established reputation for quality and innovation.

- Diverse Product Portfolio: The company has a wide range of products and services, which reduces reliance on any single market or sector.

- Global Operations: EMR’s global footprint allows it to tap into growth opportunities in various regions and buffer against regional economic fluctuations.

- Dividend History: A track record of increasing dividends for 65 consecutive years appeals to investors and demonstrates financial discipline and reliability.

Weaknesses:

- Market Saturation: In some segments, EMR faces challenges in terms of market saturation, which can limit growth.

- Complexity of Operations: Managing a large and globally dispersed operation can lead to inefficiencies and higher costs.

- Cyclical Nature of Industries: Many of EMR’s sectors are cyclical, making its performance susceptible to economic cycles.

Opportunities:

- Innovation and R&D: Continuing to invest in research and development can lead to new product lines and improvements in existing products.

- Emerging Markets: There is potential for growth in emerging markets, which could provide new revenue streams.

- Strategic Acquisitions: Acquiring complementary businesses could provide new technologies and enhance market share.

Threats:

- Competitive Pressure: Intense competition in the industrial sector could lead to price pressures and margin erosion.

- Global Economic Conditions: Economic downturns or instability in key markets could impact demand for EMR’s products.

- Technological Disruption: Rapid technological change could render some of EMR’s products or services obsolete if the company does not adapt swiftly.

This SWOT analysis highlights the balanced approach needed for EMR to leverage its strengths and opportunities while mitigating the risks posed by its weaknesses and external threats.

Competitors

Emerson Electric Co. (EMR) operates in a competitive landscape, facing off against major players in the industrial and technology sectors. While specific competitors can vary by business segment, here are five companies typically considered to be among Emerson’s top competitors based on industry presence and product offerings:

- ABB Ltd. (ABB): A global leader in power and automation technologies, ABB competes with Emerson in several areas, including process automation and electrification products.

- Siemens AG (SIEGY): Siemens is a powerhouse in industrial manufacturing, energy, and automation, with a broad range of products and services that overlap with Emerson’s offerings.

- General Electric Company (GE): With its diverse portfolio, GE competes with Emerson, especially in the areas of power generation, industrial automation, and digital solutions.

- Honeywell International Inc. (HON): Honeywell’s wide array of industrial products, including control technologies for buildings, homes, and industry, places it in direct competition with Emerson.

- Rockwell Automation (ROK): Specializing in industrial automation and information, Rockwell Automation competes with Emerson’s automation solutions.