PepsiCo, Inc. (PEP), a global leader in the food and beverage industry, boasts a diverse portfolio that extends beyond its flagship Pepsi soda to include a wide array of snacks, foods, and beverages. With brands like Frito-Lay, Gatorade, Quaker, and Tropicana under its umbrella, PepsiCo has cemented its status as a powerhouse in both the snack food and beverage sectors. The company’s success is built on a foundation of strong marketing, innovation, and an expansive distribution network that ensures its products are enjoyed by consumers worldwide.

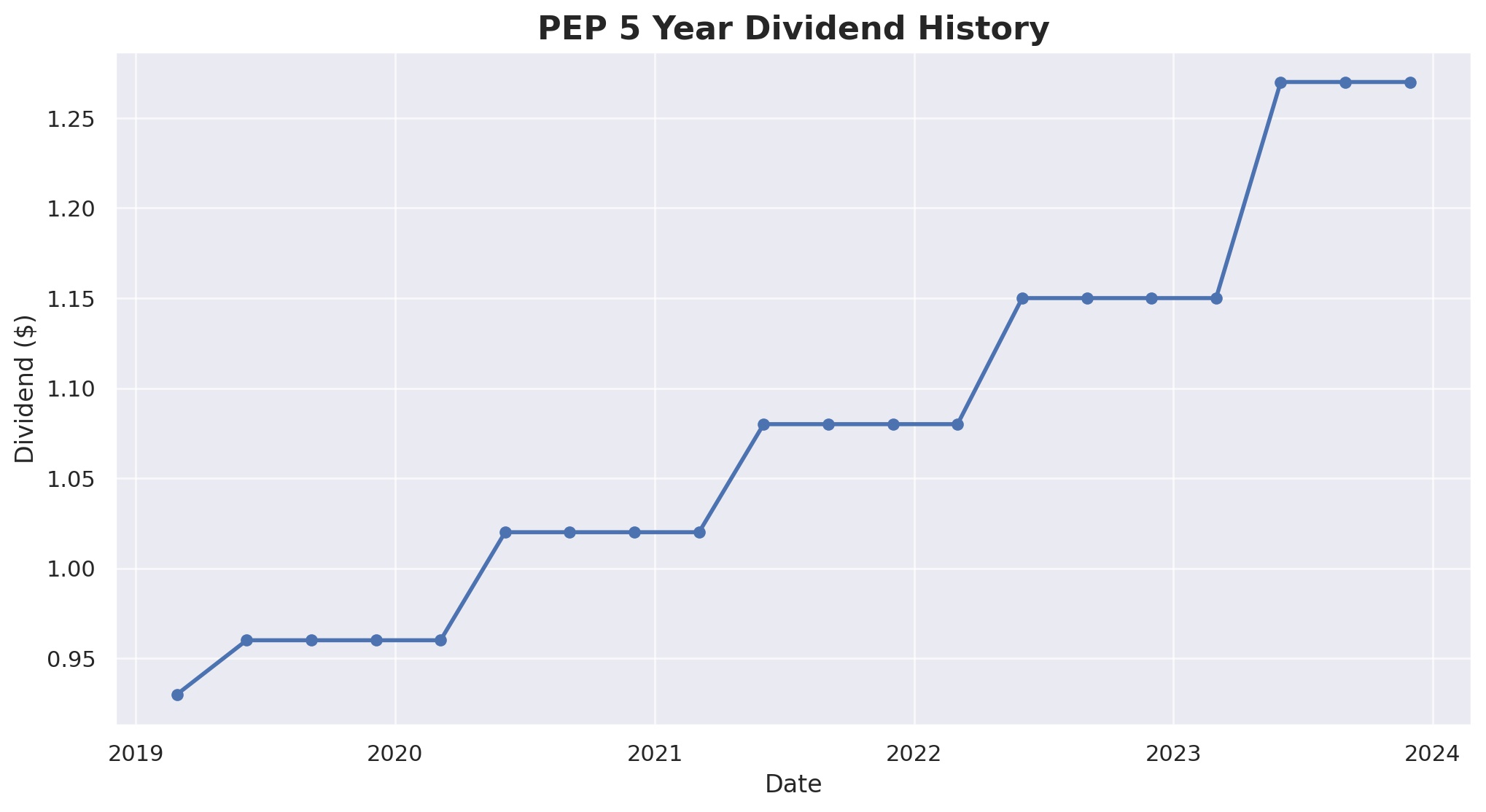

A notable hallmark of PepsiCo’s financial prowess is its remarkable track record of dividend growth, with the company increasing its dividend for 50 consecutive years, earning it the prestigious title of a Dividend King. This achievement not only underscores PepsiCo’s commitment to returning value to its shareholders but also reflects its operational resilience and strategic financial management, which have allowed it to navigate through various market cycles while continuing to invest in growth and expansion.

Analyst Ratings

- Lauren Lieberman from Barclays maintained a “Buy” rating on January 16, 2024, adjusting the price target from $181 to $179, indicating a potential upside of +4.56%.

- Andrea Teixeira at JP Morgan changed the rating from “Buy” to “Hold” on December 19, 2023, with a price target adjustment from $185 to $176, suggesting a +2.81% upside.

- Kaumil Gajrawala of Jefferies initiated coverage with a “Strong Buy” rating on November 13, 2023, setting a price target of $203, which implies an +18.58% potential upside.

- Axel Herlinghaus from DZ Bank upgraded the stock from “Hold” to “Strong Buy” on October 19, 2023, with a price target of $187, indicating a +9.24% upside.

- On October 12, 2023, Lauren Lieberman at Barclays maintained a “Buy” rating but lowered the price target from $166 to $154, reflecting a -10.04% downside.

- Andrea Teixeira of JP Morgan, on October 11, 2023, maintained a “Buy” rating, adjusting the price target from $188 to $185, suggesting an +8.07% upside.

- Filippo Falorni at Citigroup kept a “Hold” rating on October 11, 2023, with a price target change from $200 to $180, indicating a +5.15% potential upside.

- Dara Mohsenian from Morgan Stanley maintained a “Hold” rating on October 11, 2023, with a price target adjustment from $210 to $190, pointing to a +10.99% upside.

- Nik Modi of RBC Capital reiterated a “Hold” rating on October 11, 2023, with a steady price target of $180, suggesting a +5.15% potential upside.

Insider Trading

Over the past 6-12 months, PepsiCo (PEP) has seen a mix of insider buying and notable selling activities, reflecting diverse confidence and financial strategies among its executives and directors. Notably, a series of contract buys were observed on December 1, 2023, where insiders such as Edith W Cooper, Susan M Diamond, and Daniel L Vasella, among others, purchased shares at $168.69, each investing $60,000. This series of transactions suggests a collective belief in the company’s value at that price point.

On the other side, Hugh F Johnston, the CFO, executed a significant sale on November 10, 2023, offloading 48,388 shares at $166.6543 each, totaling over $8 million. This move might raise eyebrows, but it’s essential to remember that insider sales can be motivated by various personal financial planning needs rather than a lack of faith in the company’s future. In October 2023, numerous insiders engaged in contract buys at a $0 transaction cost, indicating a different form of compensation or investment, adding another layer to the financial maneuvers within PepsiCo’s executive ranks. These activities, from strategic acquisitions to divestitures, offer a glimpse into the confidence and investment strategies of those at the helm of PepsiCo.

Dividend Metrics

Pepsi, a stalwart in the beverage and snack industry, has not only quenched thirsts but also investor thirst for consistent, long-term returns. It has achieved a landmark status as a Dividend King, having increased its dividends for 50 consecutive years. With a current yield of 2.92%, Pepsi overshadows its five-year average yield of 2.75%, an indicator of its yield’s growth over time. This growth is further evidenced by a solid 7.39% increase in its dividend over the past five years.

The company’s ability to consistently raise dividends is supported by a one-year revenue growth percentage of 6.70%, despite a payout ratio that sits at 80%, which indicates a substantial portion of earnings is being returned to shareholders. However, this substantial payout ratio has not hindered Pepsi’s financial performance, as evidenced by only a slight dip of -1.13% in one-year return percentage, showcasing the company’s resilience in maintaining shareholder value amidst market fluctuations.

Dividend Value

PepsiCo’s current dividend yield of 2.92% stands notably higher than its five-year average of 2.75%, potentially indicating an attractive valuation for dividend investors. This higher yield might suggest that the stock is undervalued relative to its historical performance, especially when considering the company’s robust history of dividend growth. While the market has seen its fluctuations, PepsiCo’s yield premium could be seen as a beacon for value seekers, implying that the stock might offer a favorable income stream relative to its past, without any explicit assurances of dividend stability.

The comparison between PepsiCo’s current yield and its five-year average also sheds light on the company’s ability to sustain and grow its dividends over time, reflective of strong underlying financial health. For investors, the yield difference could signal an opportunity for both income and potential capital appreciation, especially in a market environment where sustained yield growth is a sign of corporate resilience and strategic foresight in capital allocation.

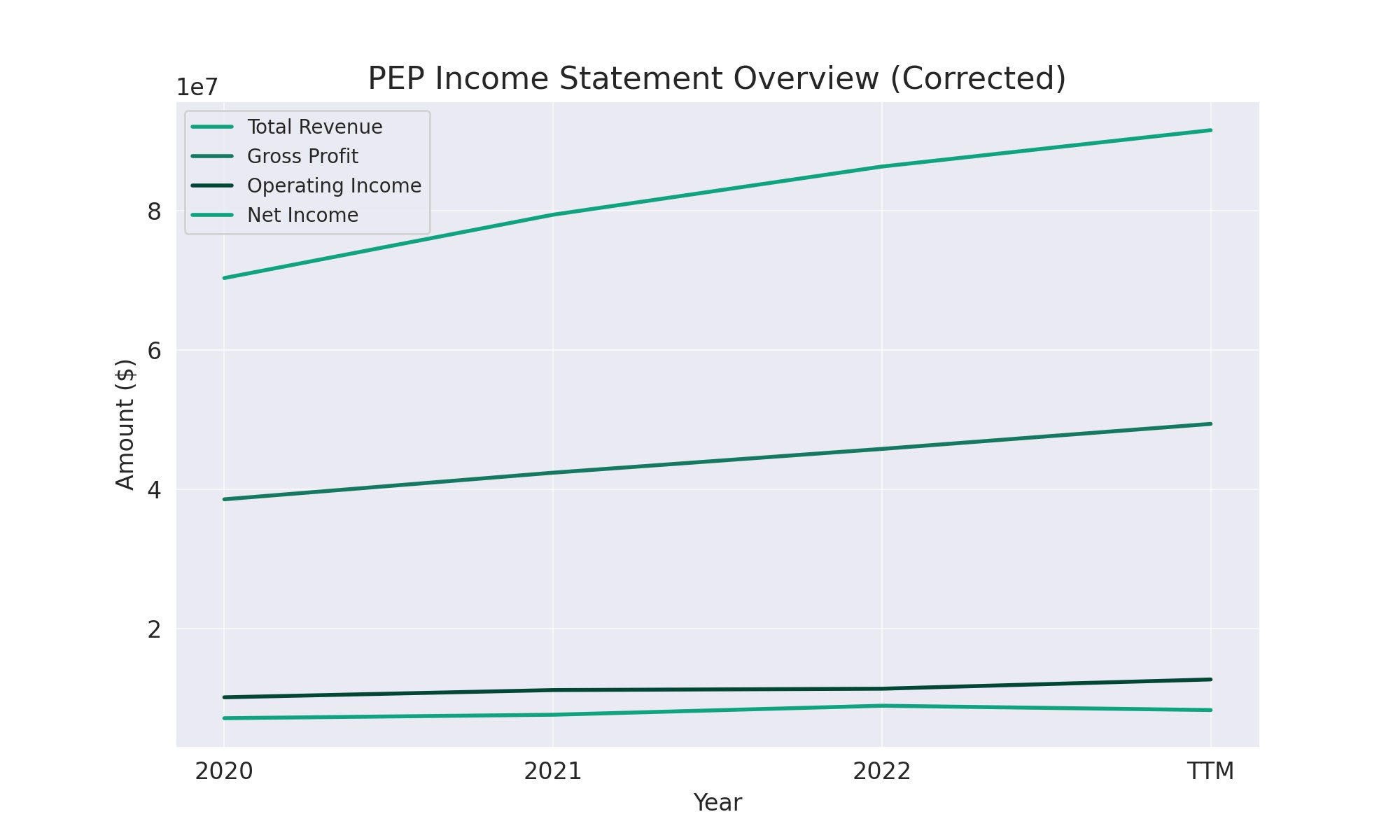

Income statement Analysis

Pepsi’s income statement looks like the menu of a well-established restaurant – diverse and substantial, with revenues that have grown from $70,372,000 TTM in 2020 to a flavorful $91,617,000 TTM by the end of 2022. The cost of revenue, mirroring the cost of ingredients for a culinary feast, has also risen, but at a pace that’s allowed gross profit to expand from $38,575,000 TTM to $49,413,000 TTM, suggesting that Pepsi has been mixing its financial ingredients wisely to cook up some appetizing margins.

Operating expenses have nibbled away at the gross profit, but operating income has held steady, boasting a solid $12,688,000 TTM in 2022, up from $10,122,000 TTM in 2020, hinting at a recipe for operational efficiency. Meanwhile, net income available to common stockholders dipped slightly from $8,910,000 TTM in 2021 to $8,290,000 TTM in 2022, but not enough to spoil the financial feast. The EPS, both basic and diluted, have slightly retreated from their previous highs, much like a diner leaning back after a satisfying meal, suggesting that while growth is still on the menu, it might come with a side of cautious optimism moving forward.

Balance sheet Analysis

Diving into the balance sheet of our unnamed but surely caffeinated entity, we observe a slight fluctuation in its total assets, from a high of $92,918,000 in the year before the year before last to a more grounded $92,187,000 in the latest TTM report. This gentle decline in assets suggests that the company’s asset acquisition spree has taken a modest pause, possibly to catch its breath or perhaps to enjoy a sip of its own product. Despite this, the assets seem to have had a minor hiccup rather than a full-on burp, indicating a stable foundation with minor shifts in its financial landscape.

On the liabilities and equity front, it’s a tale of reducing burdens and bulking up on equity – a financial workout that’s showing results. Total liabilities net minority interest slimmed down from $79,366,000 to $74,914,000, suggesting that the company has been on a debt diet, shedding some of its financial obligations. Meanwhile, total equity gross minority interest flexed its gains from $13,552,000 to $17,273,000, showcasing a robust growth in shareholder value. This financial physique transformation, while impressive, comes with its own set of challenges, such as a negative working capital and tangible book value, painting a picture of a company that’s strong in assets and equity but still navigating through the complexities of its financial commitments and operational needs.

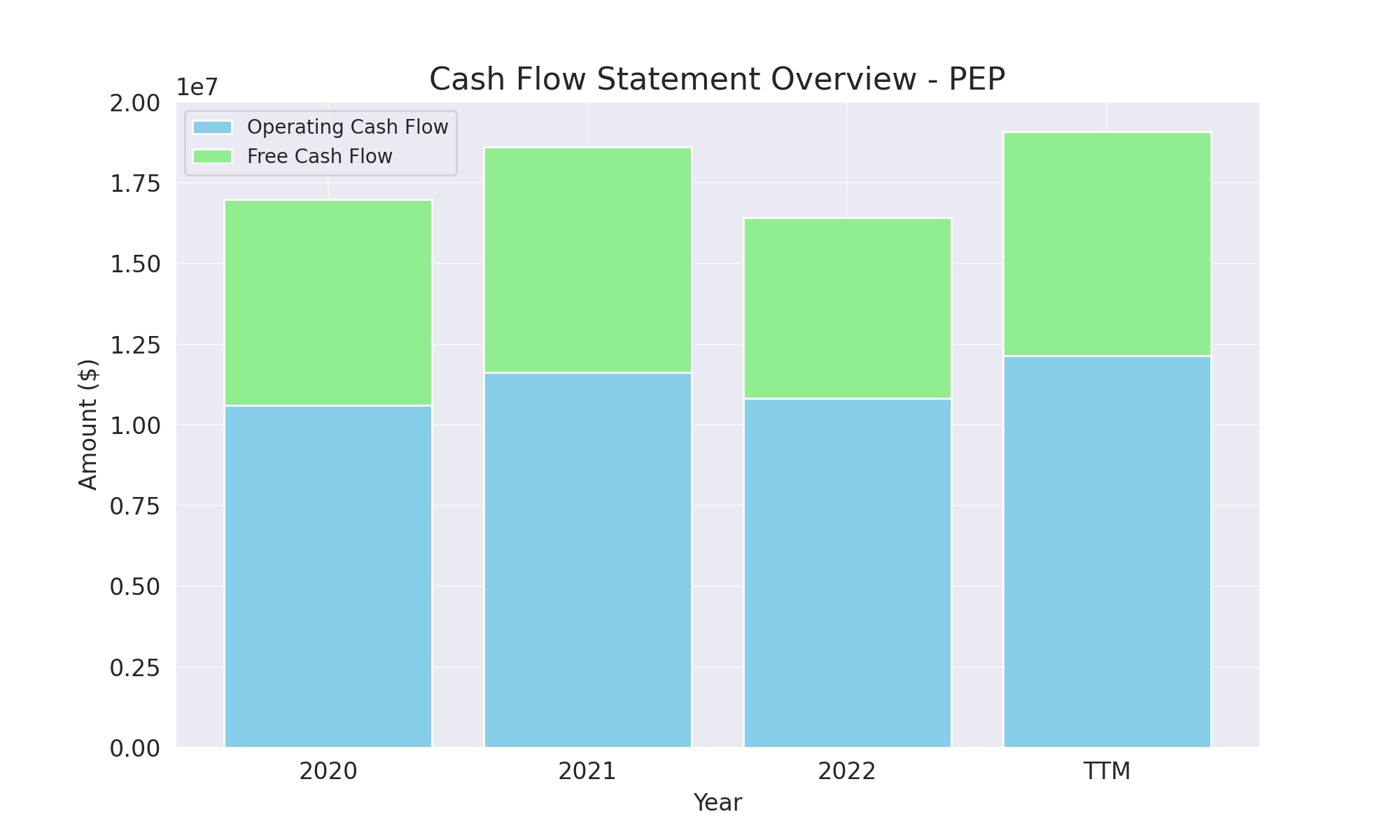

Cash Flow Statement Analysis

In the financial world, the cash flow statement of our mystery stock—let’s whimsically call it “CashFlow Co.”—reveals a journey of liquidity that’s more akin to navigating the ups and downs of a bank account than an amusement park ride. Over the past few years, CashFlow Co. has seen its operating cash flow grow from $10,613,000 to a refreshing $12,135,000 in the TTM period, reflecting a healthy inflow reminiscent of a well-hydrated athlete. This uptick indicates not only an improved operational efficiency but also a savvy ability to generate cash, much like finding a $20 bill in a pair of jeans you haven’t worn in a while.

However, the investing and financing activities tell a tale of strategic maneuvers and financial gymnastics. Investing cash flow has seen a roller—excuse me, a gentle wave—from a hefty outflow of $11,619,000 to a more moderate $5,118,000, suggesting a cautious yet calculated approach to investments, akin to someone deciding between ordering dessert or being sensible. Meanwhile, financing activities swung from a cash infusion of $3,819,000 to a payout of $2,882,000, illustrating a shift from leveraging debt to perhaps tightening the belt. The end cash position, blooming from $5,100,000 to $10,653,000, showcases a company that’s not just surviving the financial seasons but flourishing, turning financial lemons into a robust lemonade stand.

SWOT Analysis

Conducting a SWOT analysis for PepsiCo (PEP) involves examining the company’s internal strengths and weaknesses, as well as the external opportunities and threats it faces within the beverage and snack food industry. This analysis will highlight key factors that could influence PepsiCo’s strategic decisions and market position.

Strengths:

- Diversified Product Portfolio: PepsiCo’s extensive range of products across beverages and snack foods, including iconic brands like Pepsi, Gatorade, Tropicana, Lay’s, and Quaker, provides a strong competitive edge and resilience against market volatility.

- Global Presence: With operations and a distribution network spanning over 200 countries, PepsiCo enjoys a significant global footprint, allowing for a wide-reaching market presence and diversified revenue streams.

Weaknesses:

- Dependence on Retail and Foodservice Customers: Changes in consumer purchasing habits or disruptions in the retail and foodservice sectors can impact PepsiCo’s sales. The company must continuously adapt to consumer trends and preferences.

- Health and Wellness Trends: Increasing consumer focus on health and wellness poses a challenge for PepsiCo, necessitating innovation and adaptation in product offerings to include healthier options and reduce reliance on sugary drinks and snacks.

Opportunities:

- Expansion in Emerging Markets: There’s significant growth potential in emerging markets, where increasing urbanization and disposable incomes can drive demand for PepsiCo’s products.

- Innovation and Product Diversification: Continuing to innovate and expand into healthier product lines, such as non-sugar beverages and nutritious snacks, aligns with global health trends and opens new market segments.

Threats:

- Intense Competition: PepsiCo faces stiff competition from other global giants like Coca-Cola, as well as local players in various markets, which can pressure prices and market share.

- Regulatory Challenges: Government regulations regarding health, environment, and packaging, especially those aimed at reducing sugar consumption and plastic use, can impact operational costs and product formulations.

This SWOT analysis underscores PepsiCo’s strong position in the global food and beverage industry, while also highlighting areas where strategic adjustments are necessary to address challenges and capitalize on emerging opportunities.

Competitors

Here’s a summary of PepsiCo’s top five competitors:

- The Coca-Cola Company (KO): Coca-Cola is PepsiCo’s archrival and the most direct competitor in the non-alcoholic beverage sector. Known for its flagship Coca-Cola soda, the company also offers a wide range of beverages, including water, teas, and juices. Coca-Cola’s global brand recognition and extensive distribution network make it a formidable competitor.

- Nestlé S.A. (NSRGY): Although primarily recognized for its leadership in the food and nutrition sector, Nestlé competes with PepsiCo in the beverage and snack food categories with products like Nestlé Pure Life water, Nescafé, and KitKat. Nestlé’s vast portfolio in both food and drinks places it as a significant competitor in the global market.

- Mondelēz International, Inc. (MDLZ): Mondelēz is a major player in the snack food industry, competing directly with PepsiCo’s Frito-Lay and Quaker Oats brands. With popular brands like Oreo, Cadbury, and Trident gum, Mondelēz has a strong international presence in the snack food market.

- Dr Pepper Snapple Group (now part of Keurig Dr Pepper (KDP)): Keurig Dr Pepper represents a consolidation of beverage brands that compete across several of PepsiCo’s product lines, including soft drinks, juices, and teas. Brands like Dr Pepper, Snapple, and 7UP make KDP a significant competitor in the beverage industry.

- Red Bull GmbH: Specializing in energy drinks, Red Bull competes with PepsiCo’s energy drink offerings, such as Mountain Dew Game Fuel and Rockstar. Red Bull’s dominance in the energy drink segment and its strong marketing campaigns position it as a key competitor in this fast-growing market segment.