Procter & Gamble (P&G) is a multinational corporation with a rich heritage in consumer goods, boasting a vast portfolio of brands that are household names worldwide. Established in 1837, its offerings span across a variety of categories, including beauty, health care, grooming, fabric care, and home care, among others. P&G is known for its commitment to innovation, sustainability, and corporate responsibility, consistently aiming to improve the lives of consumers with products that combine value, performance, and quality.

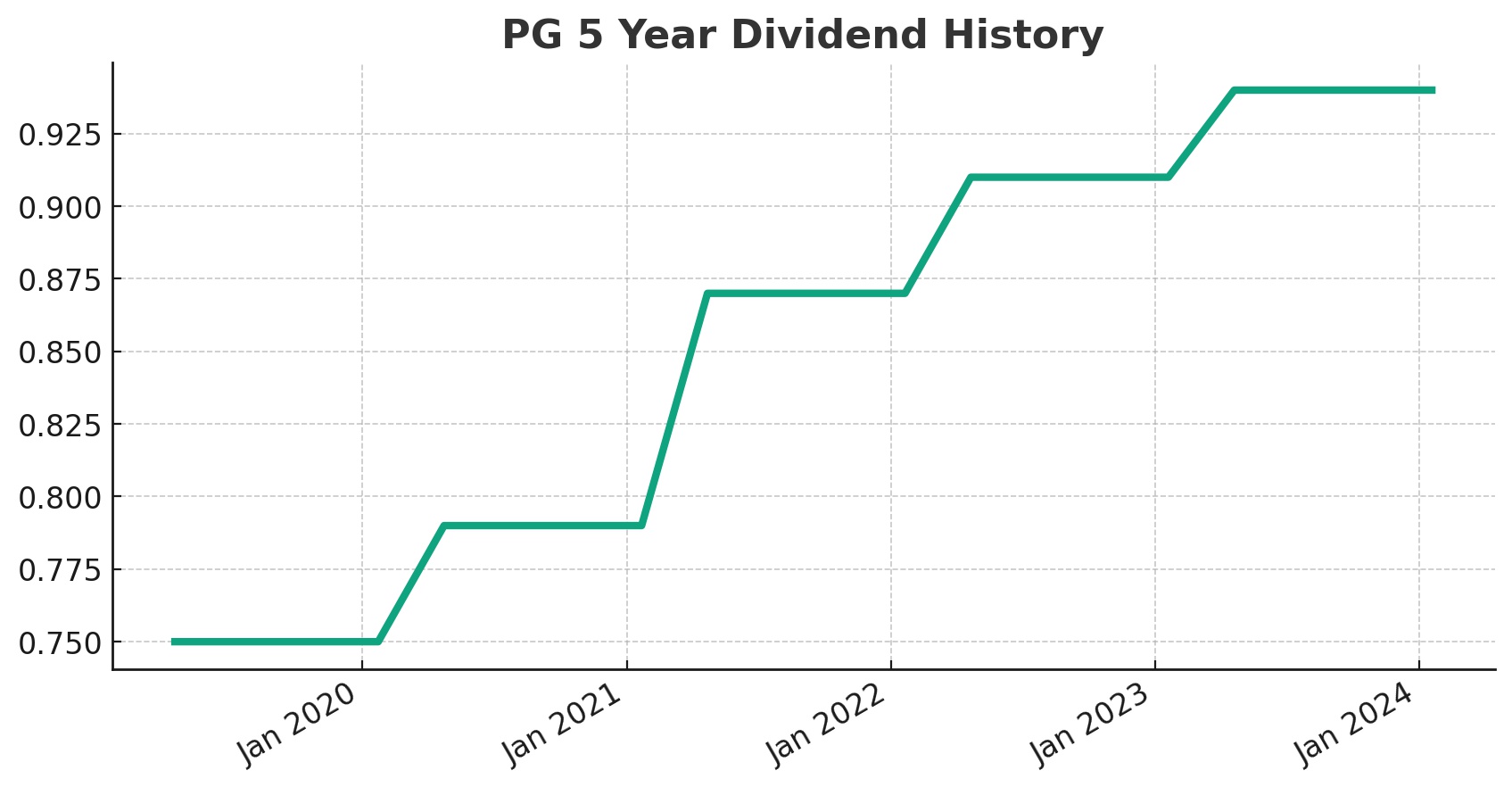

A notable aspect of P&G’s financial performance is its remarkable track record of increasing its dividend for 66 consecutive years, a feat that positions it within the prestigious group of “Dividend Kings.” This elite category is reserved for companies with at least 50 years of consecutive dividend growth, underscoring P&G’s robust financial health, stable cash flows, and commitment to returning value to shareholders. This achievement reflects P&G’s strong business model, operational efficiency, and strategic foresight in navigating market challenges while sustaining growth and shareholder returns. For investors, P&G’s status as a Dividend King highlights its reliability and appeal as a long-term investment.

Analyst Ratings

- Bill Chappell from Truist Securities rates the stock as Hold, maintaining his stance with a target price update from $155 to $160 (+1.13%) on Jan 31, 2024.

- Lauren Lieberman from Barclays maintains a Buy rating, adjusting the target price from $160 to $165 (+4.29%) on Jan 25, 2024. Earlier, on Jan 16, 2024, she updated the target from $164 to $160 (+1.13%).

- Nik Modi from RBC Capital holds the stock with a slight target price increase from $156 to $157 (-0.76%) on Jan 24, 2024.

- Mark Astrachan of Stifel also holds, adjusting the target from $155 to $157 (-0.76%) on the same day, Jan 24, 2024.

- Peter Grom at UBS gives a Strong Buy rating, with a significant target boost from $172 to $178 (+12.51%) on Jan 24, 2024.

- Chris Carey from Wells Fargo maintains a Buy rating, raising the target from $162 to $170 (+7.45%) on Jan 24, 2024.

- Olivia Tong of Raymond James keeps a Buy rating, updating her target from $170 to $175 (+10.61%) on Jan 24, 2024.

- Andrea Teixeira at JP Morgan rates the stock as Buy, though uniquely adjusting the target down from $169 to $162 (+2.40%) on Jan 18, 2024.

Insider Trading

Analyzing the buy and sell transactions for the stock over the last 6-12 months, focusing exclusively on direct sales and exercise of options without considering awards and transfers, provides insight into insider trading patterns:

- Fama V Francisco, Division CEO, engaged in multiple transactions, notably selling 45,000 shares post-exercise at $156.00 each on January 29, 2024, and another sale of 64,289 shares at $153.2991 on January 24, 2024. These sales, alongside exercises at lower prices, indicate a strategy to capitalize on stock price appreciation.

- Shailesh G Jejurikar, COO, exercised 31,275 shares at $80.2900 on January 25, 2024, and subsequently sold them at $154.9000, reflecting a significant gain.

- Bala Purushothaman, CHRO, also followed a similar pattern, exercising 14,000 shares at $80.2900 and selling them at $154.6088 on January 25, 2024.

- Marc S Pritchard, CBO, executed one of the larger transactions, exercising 101,704 shares at $78.6600 on January 24, 2024, and selling them at $153.5661, which underscores a substantial profit realization.

- André Schulten, CFO, also exercised and sold shares, including a significant transaction on November 6, 2023, where he exercised 40,298 shares at $82.4633 and sold them at $150.6090.

- R Alexandra Keith, another Division CEO, engaged in both exercising and selling shares in November, with a notable exercise of 23,783 shares at $95.0785 on November 14, 2023, and selling them at $153.4707.

These transactions indicate a pattern of insiders exercising options at significantly lower prices than the market value and then selling the exercised shares, capitalizing on the stock’s appreciation. This activity may reflect the insiders’ confidence in the company’s value and their intention to realize gains from their compensation packages. However, it’s also common for insiders to sell shares for personal financial planning reasons, not necessarily reflecting their outlook on the company’s future performance.

Dividend Metrics

The Procter & Gamble Company, with the stock symbol PG, has a strong track record in terms of dividend performance, showcasing 66 consecutive years of dividend increases. This consistency reflects a yield of 2.39%, which is supported by a 5-year dividend growth rate of 5.48%.

The company also demonstrates a steady revenue increase with a 1-year revenue growth percentage of 3.20%. PG maintains a payout ratio of 62%, indicating that it returns over half of its earnings to shareholders as dividends. Over a 5-year period, the average yield has been slightly higher at 2.46%. Lastly, PG has delivered a robust 1-year return percentage of 9.99%, underscoring its strong performance and appeal to shareholders looking for consistent growth and reliable income.

Dividend Value

The Procter & Gamble Company (PG) presents a current yield of 2.39%, which, when juxtaposed with its 5-year average yield of 2.46%, suggests a relatively stable yield performance over a mid-term horizon. This slight dip below the average indicates that the stock might be slightly overvalued, as yield inversely correlates with stock price, assuming the dividend payout has remained consistent.

In the context of yield analysis, a current yield hovering just below the historical average could imply that the stock’s price has appreciated more rapidly than dividend growth, pushing the yield percentage down. Investors seeking income might view this marginal yield compression as an indication of modest overpricing compared to the stock’s own historical yield performance. Nonetheless, the proximity of the current yield to its 5-year average also signals that the stock has not strayed far from its historical norm, potentially offering a balanced value proposition for those who prioritize dividend stability in a portfolio.

Income statement Analysis

The Procter & Gamble Company’s income statement appears to reflect a company that’s not only washing away the competition but also doing a fine job of cleaning up its revenue year over year. Total Revenue has gradually increased from $70,950,000 in 2020 to $83,933,000 in the TTM ending June 30, 2024, indicating a steady climb despite the economic ebb and flow. This is while the Cost of Revenue had a bit of a hiccup, increasing in 2022 before being trimmed down again, showing a bit of cost management gymnastics.

Meanwhile, the bottom line, Net Income for Common Stockholders, has shown resilience, with a dip in the soap opera of 2021 but recovering to a fresh scent of success at $14,489,000 in the TTM. It’s like watching a financial performance ballet, where every pirouette is a quarter’s report, and they’ve been en pointe for the last five years. Though Basic and Diluted EPS have had their ups and downs, like the gentle cycle of an eco-friendly washing machine, they’ve trended upwards, ensuring that shareholders’ investments don’t shrink after the first fiscal wash.

Balance sheet Analysis

Procter & Gamble’s balance sheet seems to be playing a steady game of financial Tetris, with total assets gently oscillating from $120,700,000 in 2020 to $120,829,000 in the TTM ending June 2023, almost returning to its two-year prior form. While Total Liabilities Net Minority Interest took a brief excursion down to $70,354,000 in 2022, they decided they missed the heights and climbed back up to $73,764,000 in the TTM. It’s almost as if the liabilities were on a yo-yo diet, trimming down before bulking back up.

The equity section stands like a proud parent watching their child at a piano recital, virtually unchanging with a minor applause-worthy increase from $46,878,000 in 2020 to $47,065,000 in the TTM. And if tangible assets had a relationship status, it would be “It’s complicated,” showing a net tangible assets figure that decided to dive deeper into the negatives, reaching -$17,665,000. Meanwhile, the working capital seems to have taken a trip to the negatives and liked it there so much it decided to stay, settling at -$13,108,000 in the TTM, suggesting that the company’s short-term obligations outweigh its liquid assets. This isn’t necessarily cause for alarm, but it does raise an eyebrow – perhaps it’s a strategic financial contortion act that only the company’s accountants truly understand.

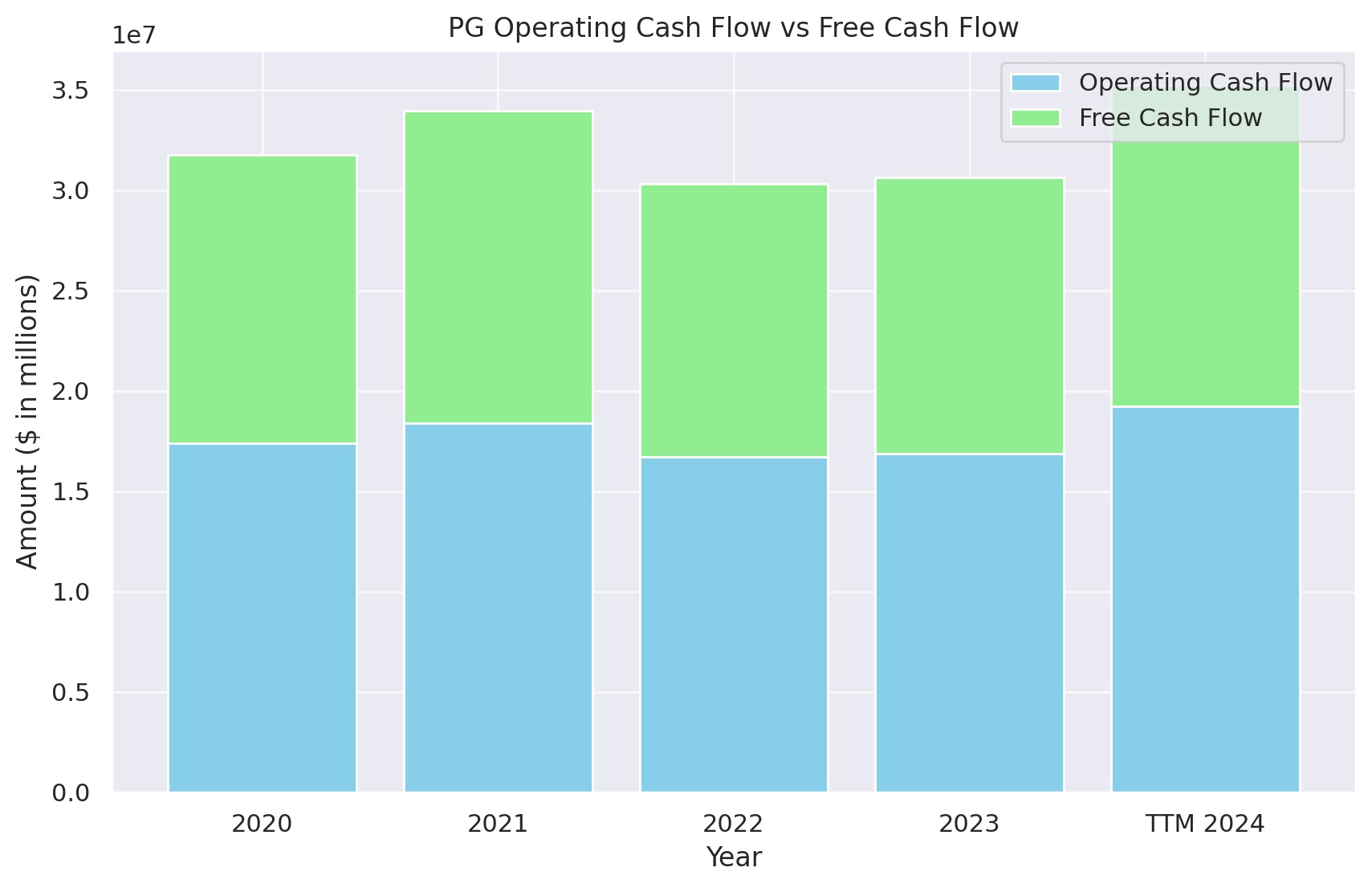

Cash Flow Statement Analysis

Procter & Gamble’s cash flow statement reads like the script of a finance drama, with Operating Cash Flow as the protagonist showing a robust performance of $19,208,000 in the TTM. This is a notable uptick from the previous years, suggesting that the company’s daily operations are generating more cash than a lemonade stand on a sweltering summer day. Investing Cash Flow, on the other hand, seems to be the necessary evil, consistently negative, and sitting at -$4,402,000 for the TTM, indicating that P&G is still betting on the future, investing more cash than a squirrel preparing for a long winter.

Financing Cash Flow acts like the moody teenager of the statement, dramatically decreasing to -$13,733,000 in the TTM, perhaps signaling a timeout on heavy borrowing or shareholder payouts. Meanwhile, the End Cash Position, standing at $7,927,000 in the TTM, suggests that the company’s cash reserves are like a well-managed diet, slightly decreasing but still healthy. The Free Cash Flow, akin to the discretionary income of the cash flow world, remains positive at $16,002,000, allowing P&G the financial flexibility to perhaps splurge on some corporate luxuries or tuck away for a rainy day fund.

SWOT Analysis

A SWOT analysis for Procter & Gamble (PG) provides a comprehensive view of the company’s strategic position by examining its Strengths, Weaknesses, Opportunities, and Threats:

Strengths

- Brand Portfolio: PG boasts a diverse and strong portfolio of leading brands across various segments, including Tide, Pampers, and Gillette, which have established a loyal customer base and significant market share.

- Global Presence: With operations in over 180 countries, PG’s global footprint allows it to leverage economies of scale and tap into growth in emerging markets.

- Innovation and R&D: The company’s commitment to research and development leads to constant product innovations, maintaining consumer interest and driving sales.

- Strong Financial Position: PG has a robust financial position, with consistent revenue growth, strong cash flows, and a history of dividend increases for over six decades, making it a “Dividend King.”

Weaknesses

- Dependence on Retailers: PG’s reliance on big retailers and grocers for sales exposes it to bargaining power and shifts in retailer strategies.

- Product Recalls: Occasional product recalls have the potential to tarnish brand reputation and consumer trust.

- Competition: Intense competition in the consumer goods sector from both multinational corporations and local players can pressure margins and market share.

Opportunities

- E-commerce Growth: Increasing its online presence and sales through e-commerce platforms offers a significant growth avenue, especially in the context of changing consumer shopping behaviors.

- Sustainability Initiatives: There’s growing consumer interest in sustainable and eco-friendly products. PG can capitalize on this trend by enhancing its sustainability efforts and product offerings.

- Emerging Markets: Further expansion into emerging markets presents opportunities for growth, given the rising middle class and increasing consumer spending in these regions.

Threats

- Regulatory Changes: Tightening regulations around product safety, environmental standards, and international trade can impact operations and costs.

- Economic Downturns: Global economic slowdowns can reduce consumer spending on non-essential goods, affecting sales.

- Changing Consumer Preferences: Rapid shifts in consumer preferences towards natural and organic products could challenge PG’s traditional product lines.

This SWOT analysis underscores PG’s solid position in the global consumer goods market while highlighting areas where strategic adjustments could further strengthen its standing and mitigate potential risks.

Competitors

Procter & Gamble (PG) operates in the highly competitive consumer goods sector, facing off against several formidable rivals. Here’s a summary of PG’s top 5 competitors:

- Unilever (UL): A global giant in the consumer goods industry, Unilever’s diverse portfolio spans categories similar to PG, including personal care, foods, refreshments, and home care. With its strong focus on sustainability and a broad international presence, Unilever competes directly with PG in multiple markets.

- Johnson & Johnson (JNJ): Primarily known for its healthcare products, Johnson & Johnson also competes with PG in the consumer goods space through its extensive range of baby care, skin care, and other personal care products. JNJ’s wide-reaching global operations and strong brand loyalty make it a key competitor.

- Colgate-Palmolive (CL): Specializing in oral care, personal care, home care, and pet nutrition, Colgate-Palmolive stands as a significant competitor to PG, particularly in the oral care and personal care segments. Its global footprint and strong brand names position it as a direct rival.

- Kimberly-Clark (KMB): Kimberly-Clark competes with PG in the personal care segment, offering products in categories such as baby care, feminine care, and tissue and paper products. Its well-known brands, like Huggies and Kleenex, allow it to maintain a competitive edge in these markets.

- Henkel (HENKY): Although perhaps less known in the U.S. consumer market compared to the others, Henkel is a significant competitor internationally, especially in Europe. It operates in both the consumer and industrial sectors, with strong positions in laundry & home care, beauty care, and adhesive technologies. Henkel’s focus on innovation and sustainability challenges PG in several key markets and segments.