Universal Corporation (UVV) stands as a notable figure in the agribusiness sector, primarily known for its role as the leading global leaf tobacco supplier. The company’s operations span more than 30 countries, where it sources, processes, and sells leaf tobacco to manufacturers of tobacco products. Universal’s long-standing reputation is built on its commitment to quality, sustainability, and its deep-rooted relationships with farmers and customers worldwide, ensuring a stable supply of tobacco in alignment with global demand.

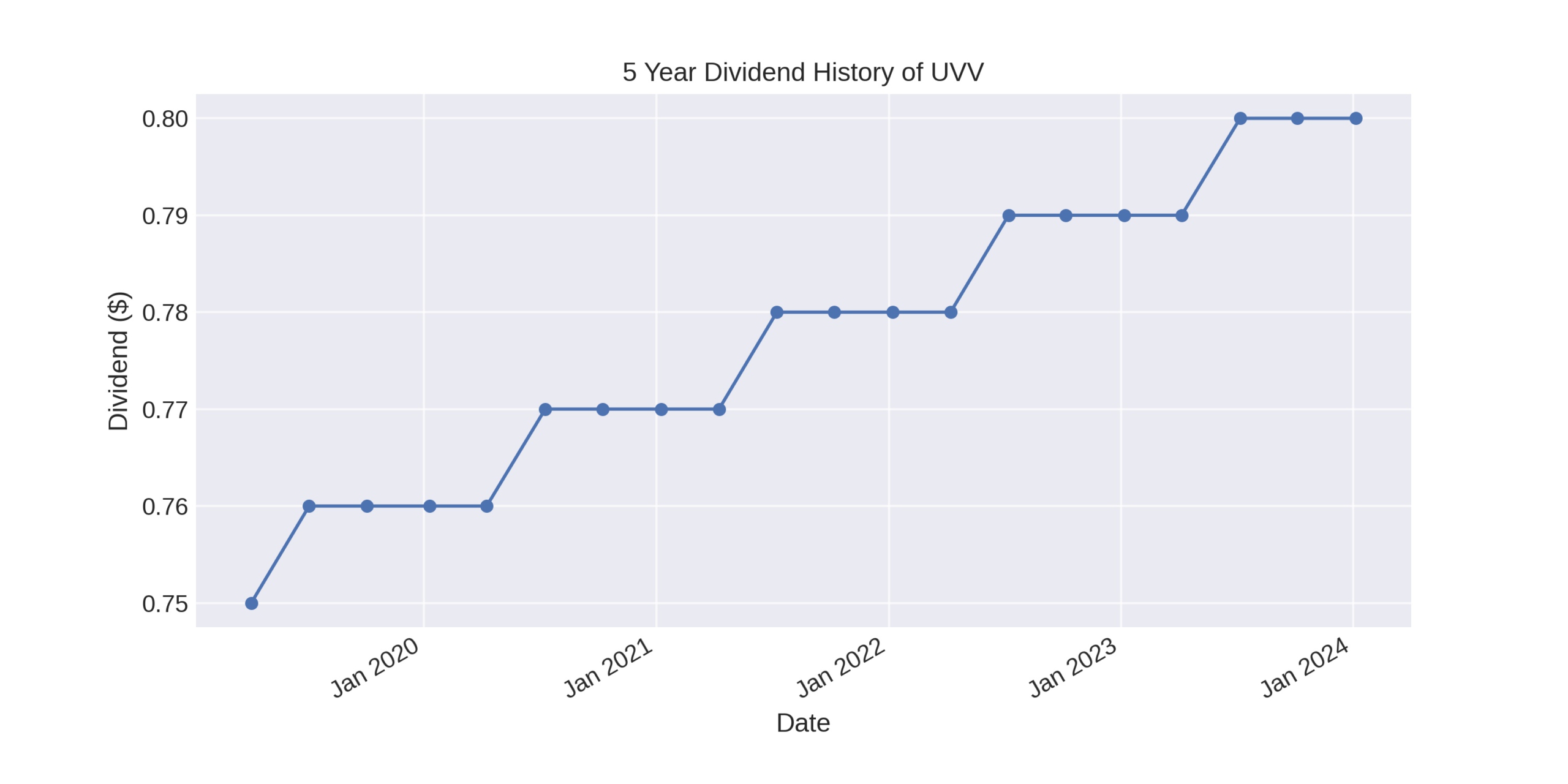

A remarkable highlight of Universal Corporation is its distinction as a Dividend King, having increased its dividend for 51 consecutive years. This achievement underscores the company’s financial stability and dedication to returning value to its shareholders, despite the challenging dynamics of the tobacco industry. An interesting facet of Universal is its adaptation to industry trends, including exploring opportunities beyond traditional tobacco, such as ingredients for the pharmaceutical and food industries, demonstrating its agility in navigating the evolving market landscape.

Insider Trading

Over the last 6 to 12 months, there have been several notable transactions involving insiders at Universal Corporation, providing insights into the trading behavior of its top executives and directors. Notably, George C. Freeman III, the Chair and CEO, engaged in significant gifting actions, giving away a total of 15,000 shares without any transaction cost, which, while reducing his holdings, did not directly impact the market. On November 15, 2023, he gave away 10,000 shares, and on December 26, 2023, another 5,000 shares, leaving him with 333,825 shares, indicating his substantial stake and ongoing commitment to the company.

Other executives participated in selling activities, capitalizing on the stock’s market value. For instance, Candace C. Formacek, the Treasurer, sold 3,767 shares on November 22, 2023, at an average price of $54.9415 per share, totaling $206,964, and Dato Ir Robert C. Sledd sold 2,000 shares on November 20, 2023, at $53.7407 per share for a total of $107,481. Additionally, Jacqueline T. Williams and Airton L. Hentschke, the COO, also executed sales, with Hentschke selling 4,368 shares at $51.5229 each on November 8, 2023, accumulating $225,052 from the transaction. These transactions, particularly the sales, might reflect individual financial planning decisions rather than a broader commentary on the company’s future prospects, especially considering the ongoing dividends and the company’s status as a Dividend King.

Dividend Metrics

Universal Corporation, denoted by the symbol UVV, has demonstrated a commendable commitment to its shareholders through consistent dividend growth, boasting a 51-year track record of annual dividend increases. The current yield stands at a robust 5.45%, which is notably lower than the 5-year average yield of 5.97%. This divergence suggests that while dividends have grown at an average rate of 7.83% over the past five years, the stock price has also appreciated, hence the yield has slightly reduced.

Although the 1-year revenue growth shows a slight decline of 1.90%, this does not seem to have deterred investors, as evidenced by a positive 1-year return of 6.26%. The payout ratio at 65% strikes a balance, ensuring that a majority of earnings are returned to shareholders while still retaining enough to fund operations and growth initiatives. The consistent performance in dividend payments positions Universal Corporation as a stalwart among dividend kings, reflecting a stable and shareholder-friendly financial policy over the long term.

Dividend Value

Universal Corporation’s current dividend yield stands at 5.45%, which is notably below its 5-year average of 5.97%. This decrease may signal that the stock’s price has increased at a faster rate than its dividend growth, or it may reflect a recent pullback in dividend increments. The 5-year dividend growth rate of 7.83% suggests a healthy trend of increasing shareholder returns over time.

Despite the lower current yield compared to the average, investors might find reassurance in the company’s history of dividend increases, which can be interpreted as a sign of management’s confidence in the company’s financial health and its commitment to returning value to shareholders. The consistency in enhancing dividends could also hint at a stable or improving cash flow scenario, which is a crucial indicator of a company’s ability to maintain or increase dividends in the future.

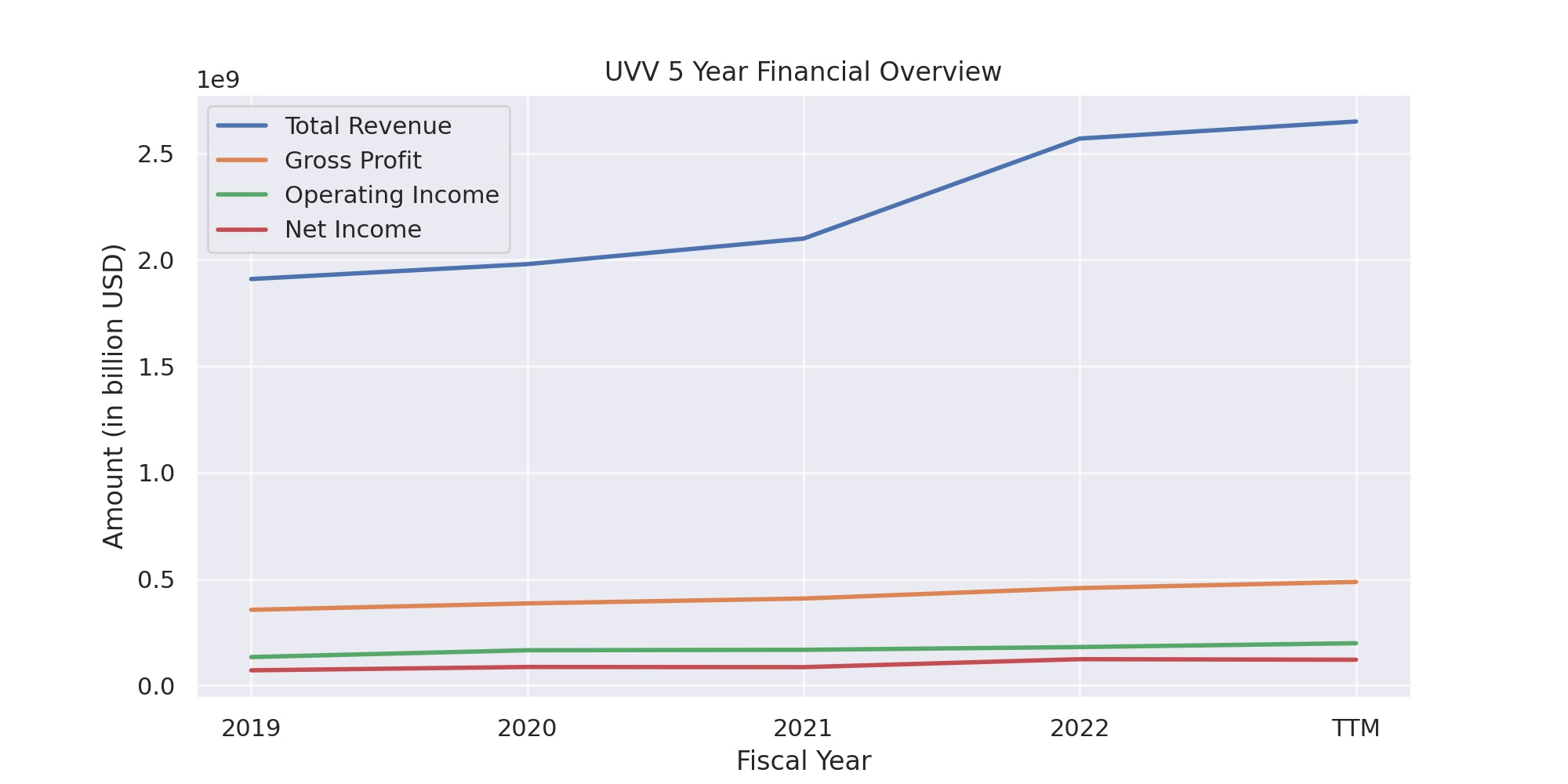

Income statement Analysis

Universal Corporation has sailed through the fiscal tides with total revenue that seems to be climbing steadily from $1.91 billion to $2.65 billion over the last four fiscal years, which could very well be the envy of many companies in calmer waters. It’s not just about raking in the money; the gross profit also shows a promising uptrend from $356 million to $487 million, indicating that the company isn’t just busy; it’s also proficient at keeping more of what it earns.

However, as we dive deeper into the sea of numbers, we encounter some undercurrents. While operating income has seen an increase from $134 million to $199 million, net income available to common stockholders has had its own mini odyssey, from $72 million four years ago to a more robust $121 million in the trailing twelve months. Despite a few waves in the form of fluctuating other income expenses and tax provisions, the company has maintained a steady course, avoiding the Sirens’ call of net losses—a testament to the captaincy at the helm of Universal Corporation.

Balance sheet Analysis

Diving into the financial depth of Universal Corporation, as of March 31, 2023, we find the total assets have grown to a solid 2.64 million. It’s as if the company has been on a shopping spree, except instead of frivolous splurges, they’ve accumulated resources that could very well be the envy of a dragon’s hoard. Liabilities, on the other hand, are standing at 1.20 million – a figure that might seem daunting, yet the company holds it up with the ease of a circus performer juggling pins.

Shifting focus to shareholder equity, we see a treasure chest worth 1.43 million. It’s not filled with gold doubloons, but it’s just as valuable to the financial buccaneers betting on the company’s success. Speaking of success, the capitalization is at 2.01 million, suggesting that the company’s fiscal ship is not just afloat but catching favorable winds. With total debt at 849,317, it seems the company has borrowed less than a pirate’s ransom, maintaining a net debt that’s more of a rowboat than a galleon at 747,683. The number of shares issued stands at a crew-size of 24,555.36, each share a vote of confidence in the company’s voyage across the tumultuous seas of commerce.

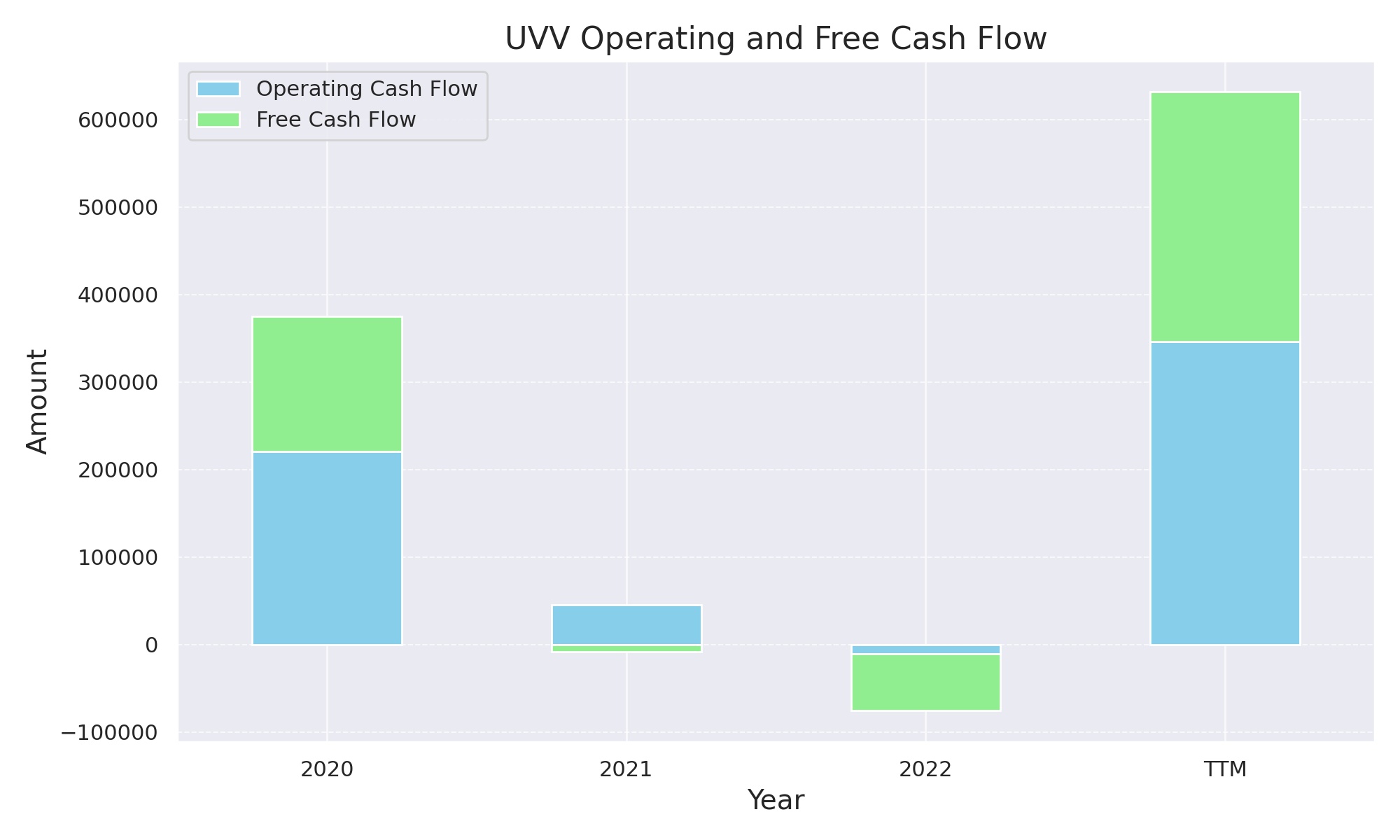

Cash Flow Statement Analysis

In the fiscal labyrinth of the past year, the company’s operating cash flow, like a magician’s surprising reveal, managed to conjure up 346,225, which might not be rabbit-out-of-a-hat level but is certainly impressive. This operational wizardry appears to have reversed a previous year’s spell that left the coffers lighter by 10,557. It’s as if the accountants were playing their own version of financial hide and seek.

The investing cash flow, on the other hand, played the part of the responsible adult, taking away 54,734 for what one can only assume are ‘investments for the future’ – the corporate equivalent of hiding the Halloween candy to ration it. Meanwhile, the financing cash flow seems to have pulled a Houdini, escaping the confines of the company’s bank account by 257,250. It leaves one to ponder whether this was a strategic act or financial escapism. In the end, the cash position stands at a comfortable 99,096, a number that doesn’t quite call for popping the champagne, but it’s not a call to the emergency fund either. It seems the company’s financial narrative could be less of a thriller and more of a bedtime story – no dramatic cliffhangers here, just the steady turn of the page.

SWOT Analysis

Strengths:

- Established Market Position: Universal Corporation has a strong global presence as one of the leading leaf tobacco suppliers, securing a robust market position with extensive experience in its field.

- Dividend History: With over 50 years of consecutive dividend increases, the company showcases a strong commitment to returning value to its shareholders, indicating financial health and stability.

- Diversified Supply Chain: A well-established network across multiple continents allows for a steady supply of product, reducing dependency on any single market.

Weaknesses:

- Regulatory Risks: The tobacco industry faces significant regulatory scrutiny, which can impact Universal Corporation’s operations and profitability.

- Market Volatility: Dependence on agricultural products means that the company is subject to fluctuations in quality and quantity due to environmental factors.

- Health Trends: The global shift towards healthier lifestyles poses a risk to the demand for tobacco products.

Opportunities:

- Market Expansion: There’s potential to expand into emerging markets where demand for tobacco products may still be growing.

- Product Diversification: Branching out into related sectors such as e-cigarettes, vaping, or other nicotine delivery systems could provide new revenue streams.

- Sustainability Initiatives: Investing in sustainable and responsible sourcing could improve the company’s image and appeal to socially conscious investors.

Threats:

- Legal Challenges: Increasing legal restrictions and potential lawsuits related to health impacts of tobacco use can pose financial and reputational risks.

- Competitive Pressure: Intense competition from both large tobacco firms and new entrants in alternative smoking products can impact market share.

- Declining Consumption: A long-term decline in tobacco consumption globally could threaten the core business model.

Competitors

Universal Corporation operates in a unique niche within the global tobacco industry, primarily focusing on the processing and sale of leaf tobacco. Its competitors vary from other leaf tobacco merchants to larger integrated tobacco companies. The top competitors in this sector include:

- Altria Group, Inc. (MO): A leading tobacco company in the United States, known for its Marlboro brand among others, Altria also has interests in smokeless tobacco products and wine. Its diverse portfolio makes it a significant player in the tobacco industry.

- British American Tobacco p.l.c. (BAT): As one of the world’s largest tobacco companies, BAT produces cigarettes, smokeless tobacco, and vaping products, competing with Universal Corporation in the global tobacco market.

- Philip Morris International Inc. (PM): With a strong international presence, Philip Morris focuses on the manufacture and sale of cigarettes and other nicotine-containing products outside the United States, including IQOS, a heat-not-burn product.

- Imperial Brands PLC: A global tobacco company that manufactures, markets, and sells a wide range of cigarettes, tobaccos, rolling papers, and cigars. It competes directly and indirectly with Universal Corporation in the procurement, processing, and supply of tobacco leaf.

- Japan Tobacco Inc. (JT): Engaged in the manufacturing and selling of tobacco products internationally, Japan Tobacco competes across various segments, including leaf tobacco for cigarettes.