Hormel Foods Corporation (HRL), an American food company based in Austin, Minnesota, has established itself as a leading name in the production of meat and food products. With a wide array of beloved brands under its umbrella, including Spam, Dinty Moore, Skippy, and Jennie-O, Hormel has catered to the tastes of global consumers for over a century. Founded in 1891, the company has evolved from a local meat market to a multinational corporation, emphasizing innovation, quality, and sustainability in its operations.

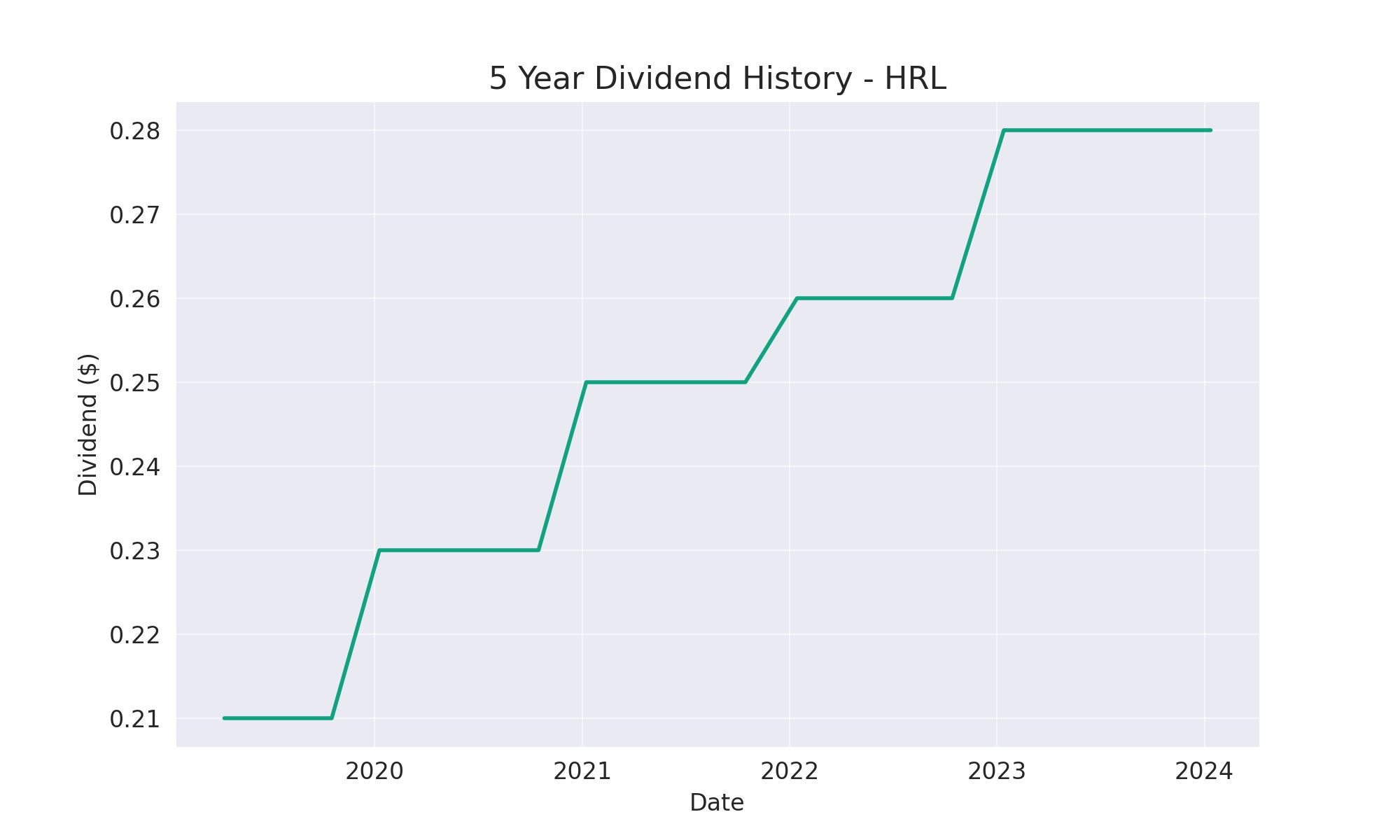

Remarkably, Hormel Foods has demonstrated an unwavering commitment to shareholder value, underscored by its impressive track record of increasing its dividend for 56 consecutive years. This achievement elevates Hormel into the prestigious ranks of the Dividend Kings, a testament to its financial health, steady growth, and the resilience of its business model even amidst fluctuating market conditions. For investors, this signifies not just Hormel’s ability to generate and distribute wealth consistently but also its position as a staple in portfolios seeking stable, long-term returns.

Analyst Ratings

- Thomas Palmer from Citigroup initiates with a “Hold” rating and sets a price target of $31, suggesting a +3.02% upside as of Feb 1, 2024.

- Michael Lavery at Piper Sandler maintains a “Hold” rating, adjusting the price target from $31 to $33, indicating a +9.67% upside on Jan 12, 2024.

- Adam Samuelson from Goldman Sachs maintains a “Strong Sell” rating, lowering the price target from $29 to $26, predicting a -13.59% downside as of Nov 30, 2023.

- Thomas Palmer at JP Morgan maintains a “Sell” rating, reducing the price target from $36 to $31, which translates to a +3.02% upside on Oct 16, 2023.

- Michael Lavery of Piper Sandler keeps a “Hold” rating, with the price target decreased from $41 to $35, showing a +16.32% upside as of Oct 13, 2023.

- Adam Samuelson at Goldman Sachs continues with a “Strong Sell” rating, adjusting the price target from $33 to $29, pointing to a -3.62% downside on Oct 13, 2023.

Insider Trading

Over the last 6-12 months, Hormel Foods Corporation (HRL) has seen a series of insider transactions, showcasing a mix of sales post-exercise and direct buys that reflect the confidence and strategic financial moves of its key executives. Notably, James P. Snee, the Chair & CEO, marked a significant transaction with a sale post-exercise on February 1, 2024, offloading 13,087 shares at $30.86, a move that adjusted his holding but maintained a substantial stake in the company, signaling perhaps a balancing act between personal portfolio management and continued belief in the company’s trajectory.

On the buying side, Pierre M. Lilly made a notable direct purchase on September 6, 2023, acquiring 1,454 shares at $37.25, an action that might be interpreted as a vote of confidence in the company’s value and future prospects. Similarly, several executives engaged in contract buys and sales post-exercise, including notable sales by Susan K. Nestegard and Kevin Myers, which could suggest taking advantage of the stock’s performance or personal financial planning. These transactions, set against the backdrop of Hormel’s consistent dividend increases, offer a glimpse into the insider sentiment, blending optimism with prudent financial maneuvers.

Dividend Metrics

Hormel Foods Corporation (HRL), a stalwart in the food industry, has a commendable track record of increasing dividends for an impressive 56 consecutive years, reflecting a strong commitment to delivering shareholder value. The company’s current dividend yield stands at 3.68%, which is a significant leap from the five-year average yield of 2.17%, hinting at a juicier return for income-focused investors. Over the last five years, HRL has also managed to churn out a dividend growth rate of 9.9%, showcasing robust fiscal health and a generous approach to profit sharing.

However, the table isn’t entirely set with good news, as the one-year revenue growth has dipped by 2.60%, perhaps indicating a recent slowdown in sales growth or a momentary blip in an otherwise consistent performance. The payout ratio, currently at 75%, may suggest that a substantial portion of earnings is being used to maintain the dividend, a sign of commitment to dividends even in less bountiful times. Despite these solid dividend figures, HRL’s one-year return percentage paints a sour picture at -32.33%, suggesting that the market may have spiced the stock with a bit of skepticism, possibly due to external economic pressures or sector-specific challenges.

Dividend Value

Hormel Foods Corporation (HRL) presents an appealing picture for those with an appetite for steady dividend yields. The company’s current yield of 3.68% stands out as particularly hearty when placed beside the five-year average yield of 2.17%. This richer yield suggests that HRL’s stock may now be on the menu for value investors hungry for income, serving up a more substantial portion of profitability in the form of dividends relative to its historical performance.

The significant spread between the current yield and its historical average could indicate that the stock is undervalued, offering a potentially discounted price for a company that has consistently increased dividends, which may be a savory pick for investors seeking both income and potential capital appreciation in a market that has been recently starved for yield.

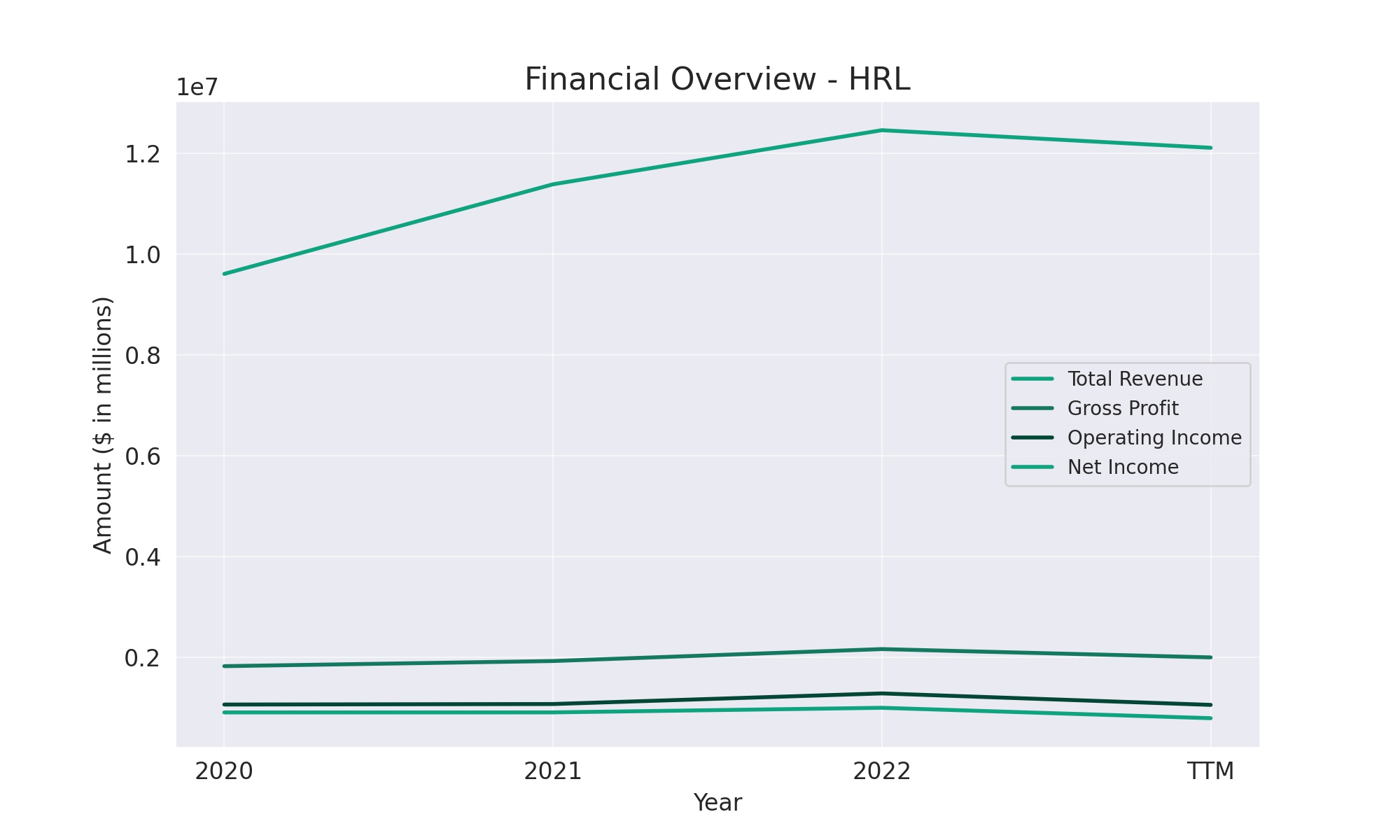

Income statement Analysis

In the trailing twelve months leading up to October 2023, the income statement for Hormel Foods Corporation (HRL) reflects a kitchen busy with financial activity, yet not without its share of spills. The total revenue remained consistent at $12,110,010, mirroring the previous year’s number as if the company has been following a tried-and-true recipe to the letter. The cost of revenue, representing the ingredients to HRL’s fiscal feast, also stayed the course at $10,110,169, which resulted in a gross profit of $1,999,841—tasty, though not quite a buffet of growth compared to the previous years.

Operating income tells a story of a modest feast at $1,057,674, not quite the banquet seen in previous years but still enough to leave the table satisfied. The after-dinner mint, known as net income to common shareholders, sweetened slightly to $793,572, a dessert slightly smaller than the previous year’s ending. With basic and diluted earnings per share both at $1.45, it’s as if the company’s earnings per share chef decided to serve a dish that’s reliable, if not particularly adventurous. Amidst a stable menu of financial metrics, HRL continues to cook up a strategy that keeps the diners—ahem, investors—coming back for more.

Balance sheet Analysis

As we sift through Hormel Foods Corporation’s balance sheet for the trailing twelve months ending October 2023, we uncover a pantry that’s moderately stocked with total assets amounting to $13,448,772. This represents a slight increase from the previous year’s $13,306,919, suggesting that the company has been shopping wisely, albeit not splurging on extravagances. The total liabilities net minority interest seem to have taken a minor detour down to $5,709,787, perhaps indicating that the financial chefs at HRL have been prudent in not overleveraging their recipes for success.

On the equity front, the gross minority interest has risen to a wholesome $7,738,985, a step up from $7,540,220, giving shareholders a little extra gravy to savor. The net tangible assets, those without the seasoning of intangibles like goodwill, stand at a hearty $1,049,251, though this is more of a light snack compared to two years prior when it was a more robust $2,736,536. With a total debt simmering at $3,309,248, Hormel maintains a reasonable level of leverage, keeping its financial soup from boiling over. In essence, the balance sheet suggests that Hormel Foods is maintaining a steady diet of asset growth and liability management, without any indigestion-causing financial surprises.

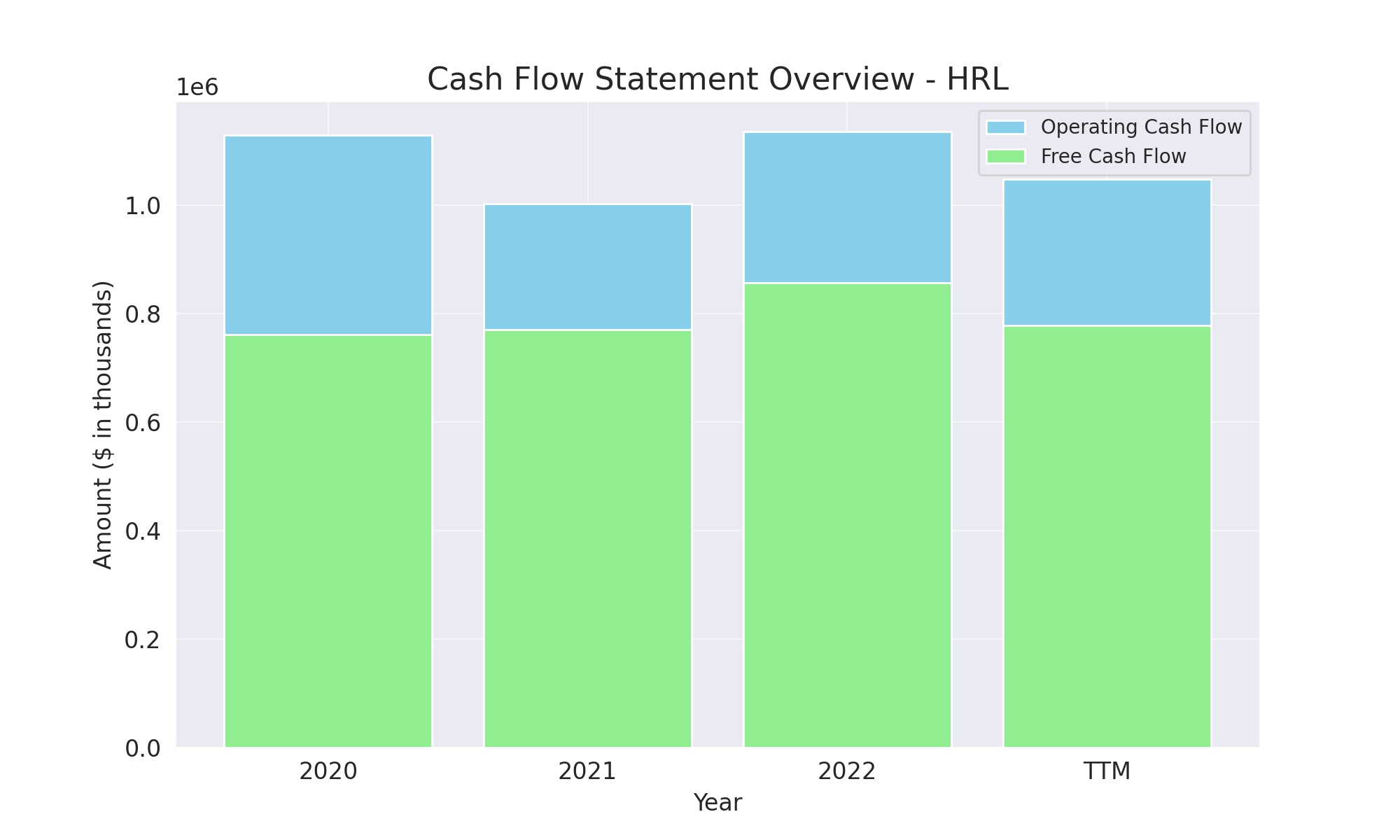

Cash Flow Statement Analysis

Hormel Foods Corporation’s cash flow statement over the trailing twelve months up to October 2023 seems to have a lot cooking, with operating cash flow simmering at $1,047,847. This figure is consistently robust, much like a well-aged cheese, hinting at a business that keeps the cash registers ringing even as market tastes shift. The company’s investing cash flow, however, has seen a significant outpouring of $689,544, indicative of a company that’s not afraid to plant seeds for future growth, even if it means digging deep into the pockets now.

On the financing front, Hormel has been less of a high roller with a cash outflow of $600,064, showing a level of fiscal conservatism akin to someone who avoids the pricey organic avocados at the supermarket. The end cash position, standing at $736,532, suggests that the company’s financial pantry remains well-stocked, ready to weather any unexpected economic storms. The free cash flow, whipping up a decent $777,636, reveals that after all is said and done, Hormel still has a nice dough rising in the oven, ready to bake into future ventures or perhaps to butter the bread of its shareholders.

SWOT Analysis

A SWOT analysis for Hormel Foods Corporation (HRL) might look like this:

Strengths:

- Brand Portfolio: HRL owns a strong lineup of established and trusted brands across various food categories, which supports customer loyalty and consistent revenue streams.

- Diversified Product Range: The company’s wide array of products, including both perishable and shelf-stable items, caters to different consumer needs and dietary preferences.

- Operational Efficiency: HRL’s effective supply chain management and operational efficiencies contribute to robust margins and a strong operating cash flow.

Weaknesses:

- Market Saturation: In some segments, HRL faces a saturated market, which could limit growth opportunities and put pressure on pricing strategies.

- Commodity Price Volatility: As a producer of food products, HRL is subject to fluctuations in commodity prices, which can impact the cost of goods sold and squeeze profit margins.

Opportunities:

- Health and Wellness Trend: With consumers increasingly seeking healthier food options, HRL can capitalize on this trend by expanding its portfolio of organic and natural products.

- Global Expansion: There is room for growth in international markets, where HRL can leverage its strong brand reputation to capture new customers.

- Innovation: Continued investment in product innovation can address changing consumer tastes and create new revenue streams.

Threats:

- Intense Competition: The food industry is highly competitive, with numerous players vying for market share, which could affect HRL’s performance.

- Regulatory Risks: Changes in food safety regulations or labeling requirements can lead to increased operational costs and affect profitability.

- Economic Downturns: Economic instability can lead to decreased consumer spending on premium brands, potentially impacting HRL’s sales.

Overall, HRL’s strong brand recognition and financial stability position it well in the market, but it must navigate the challenges of intense competition and market fluctuations while seizing opportunities for innovation and global market penetration.

Competitors

Hormel Foods Corporation competes with several key players in the food industry, each with their strengths and market presence:

- Tyson Foods, Inc. (TSN): A leader in chicken, beef, and pork processing, Tyson is a major competitor in the protein-rich food segment.

- Conagra Brands, Inc. (CAG): Offering popular brands across various grocery categories, Conagra competes with Hormel in the processed foods and meals sectors.

- Kraft Heinz Company (KHC): With a vast portfolio of products ranging from condiments to meals, Kraft Heinz is a significant competitor in the packaged foods market.

- General Mills, Inc. (GIS): Known for its cereals and baking products, General Mills also competes with Hormel in the convenient meal solutions space.

- Kellogg Company (K): While primarily known for breakfast cereals, Kellogg’s also provides a range of snack foods, competing in the broader food products sector.

These companies challenge Hormel Foods in various aspects of the food industry, from meat processing to snack foods, all competing for share in the consumer’s pantry.