Kimberly-Clark Corporation (KMB), renowned for its global presence in the personal care sector, stands as a testament to resilience and growth in the consumer goods industry. With iconic brands like Huggies, Kleenex, and Scott under its belt, Kimberly-Clark has woven itself into the fabric of daily life across the world, offering products that range from diapers to tissue papers. Established in 1872, the company has not only adapted to changing consumer needs and technological advancements but has also shown a steadfast commitment to sustainability and innovation.

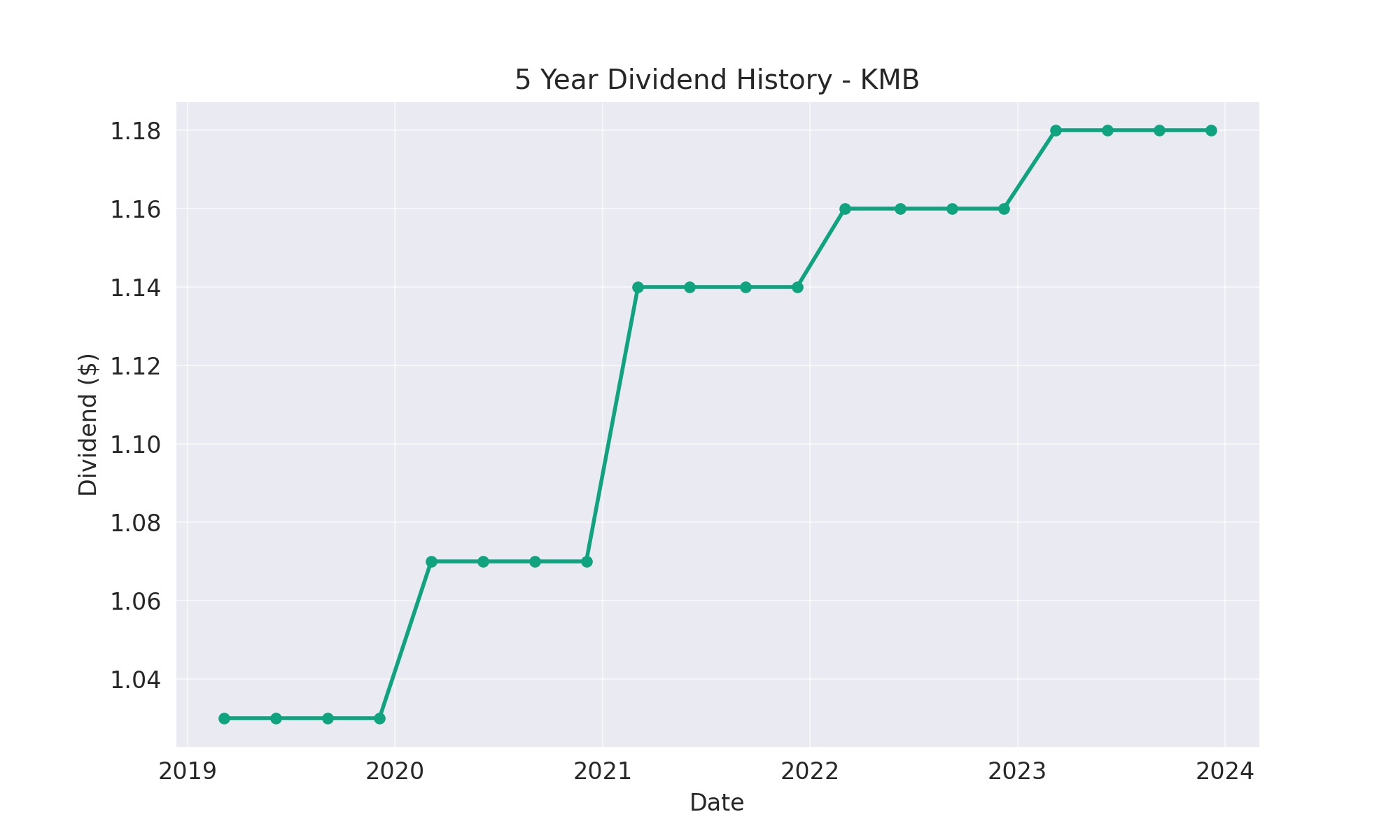

A beacon of consistency in the volatile world of stocks, Kimberly-Clark has elevated its status to that of Dividend Kings by increasing its dividend for an impressive 50 consecutive years. This remarkable streak underscores the company’s robust financial health, operational efficiency, and a forward-looking approach that balances growth with rewarding shareholders. For investors, KMB represents not just a slice of the consumer goods market, but a legacy of delivering value, making it a staple in portfolios seeking stable dividends and long-term capital appreciation.

Analyst Ratings

- Lauren Lieberman from Barclays maintains a “Hold” rating, adjusting the price target from $128 to $124, indicating a +2.20% upside as of Jan 26, 2024.

- Nik Modi at RBC Capital keeps a “Hold” rating, with the price target changed from $125 to $123, showing a +1.38% upside on Jan 25, 2024.

- Andrea Teixeira from JP Morgan maintains a “Sell” rating, revising the price target from $119 to $125, suggesting a +3.02% upside as of Jan 18, 2024.

- Lauren Lieberman again, but earlier in Barclays, maintains a “Hold” and adjusts the price target from $123 to $128, which translates to a +5.50% upside on Jan 16, 2024.

- Anna Lizzul at B of A Securities downgrades from “Hold” to “Sell,” setting a new price target of $115 from $135, pointing to a -5.22% downside as of Dec 15, 2023.

- Korinne Wolfmeyer at Piper Sandler initiates with a “Buy” rating, setting a price target of $146, indicating a significant +20.33% upside on Nov 17, 2023.

Insider Trading

Over the past 6-12 months, insiders at Kimberly-Clark Corporation (KMB) have been active in managing their stakes through various buy and sell transactions, offering insights into their confidence and strategic decisions regarding the stock. Notably, Mark T. Smucker made a direct purchase on January 29, 2024, acquiring 827 shares at $120.9805 each, totaling $100,051, a move signaling a bullish stance on the company’s prospects. This transaction stands out for its timing and the price point, indicating a potential belief in the stock’s value.

On the selling side, several executives capitalized on their positions following the exercise of options, suggesting a mix of profit-taking and portfolio adjustments. For instance, Tristram Wilkinson, Division President, exercised options for 3,720 shares at $107.5054 and subsequently sold them at $121.0000 on January 26, 2024, netting a substantial gain. Such transactions, including sales by Jeffrey P. Melucci, CLO, and Zackery A. Hicks, CDO, underline a pattern of insiders leveraging their compensation packages amidst the stock’s price movements. These activities, combined with the awards and subsequent sales, paint a picture of insiders taking advantage of the stock’s performance to realize gains, while the direct purchase by Smucker suggests a degree of optimism about the company’s future direction.

Dividend Metrics

Kimberly-Clark (KMB), with a half-century streak of dividend increases, marks its territory in the exclusive club of Dividend Kings. The company’s dividend yield, a cushy 4.01%, outpaces its five-year average yield of 3.31%, hinting at a richer income stream for investors. This yield comes amidst a backdrop of modest revenue growth, just 0.10% over the past year, possibly reflecting stable but slow market movement or a steady hand on the tiller in turbulent economic seas.

The payout ratio stands at a lofty 90%, suggesting that Kimberly-Clark is returning a significant portion of its earnings back to shareholders as dividends, a noble act that might tighten the company’s cash reserves for reinvestment. This high payout ratio, coupled with the dividend yield’s outperformance compared to historical averages, could indicate a mature company prioritizing shareholder returns over aggressive expansion or reinvestment strategies. Despite this shareholder-friendly approach, the stock has experienced a slight retreat, with a one-year return of -6.39%, a figure that may give pause to growth-seeking investors but could be a temporary dip for a company with such a strong dividend-paying track record.

Dividend Value

Kimberly-Clark’s current dividend yield of 4.01% stands as a beacon of yield in a market where such beacons are increasingly rare, especially when juxtaposed with the stock’s five-year average yield of 3.31%. This higher yield reflects not just a dividend policy that’s as comforting as the company’s own baby products, but also possibly a market price that has lagged, presenting what might be seen as a discount aisle for yield-seeking investors.

Such a yield, robust against the backdrop of historical averages, indicates that KMB might be wrapping its shareholders in a blanket of steady returns, suggesting that the company values its investors as much as consumers value its products. This could be particularly attractive in an environment where many yields are being compressed, making KMB a potentially cushy nest for those looking to lay their capital down.

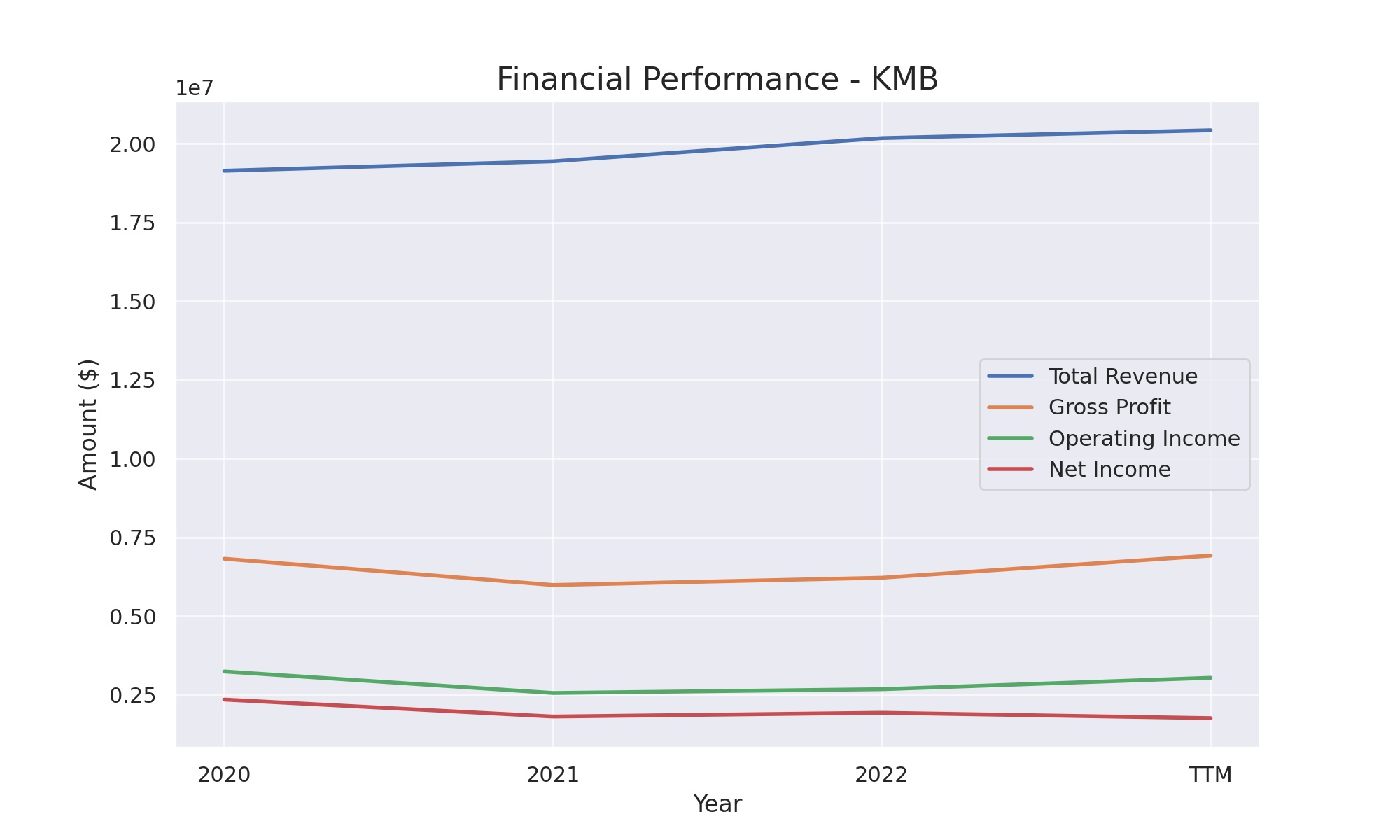

Income statement Analysis

The latest financial performance for the stock, reflected in the trailing twelve months, is like a well-oiled machine, albeit one that seems to be running a tad slower than in its prime. Total revenue crept up to $20,425,000, inching forward from the previous year’s $20,175,000, as if trying not to wake the neighbors with any sudden movements. Cost of revenue took a slight step back to $13,503,000, down from $13,956,000, perhaps the result of cost-cutting diets or smarter shopping habits.

Operating income, the bread and butter of the statement, was baked to a golden $3,044,000, not as fluffy as the $3,244,000 from two years prior, but still a respectable loaf that investors can sink their teeth into. Net income, the slice of the pie that everyone watches, settled at $1,762,000, which might not be the whole pie investors dreamt of but is enough to ensure everyone gets a piece. Basic and diluted earnings per share showed a calorie reduction from the previous year’s figures, sitting at $5.21 and $5.20, respectively. It seems that even in the realm of finance, portion control is key to maintaining health — fiscal health, that is.

Balance sheet Analysis

In the world of balance sheets, where assets and liabilities dance in a delicate balance, the stock in question here seems to have stepped on a few toes. The total assets, a robust $17,970,000, suggest that the company has been filling its coffers, albeit not as much as a dragon hoards treasure, showing a slight increase from $17,837,000 the year prior. This gradual accrual of assets might not be headline-worthy growth, but it’s akin to a quiet neighbor who surprises you with a well-tended garden.

Liabilities, those pesky obligations that companies can’t swipe left on, have also inched up to $17,270,000 from $17,100,000. Equity, the cushion shareholders rely on, sits at a modest $700,000, which seems to whisper rather than shout in the grand coliseum of market capitalization. Net tangible assets and working capital are in the negatives, painting a picture of a balance sheet that might make a minimalist smile, but a financier frown. The debt levels would make even the most liberal credit card user blush, with a total debt of $8,549,000. One might say, with equity that’s lighter than expected and debt heavier than desired, the stock’s financials resemble a seesaw that’s a bit off-kilter.

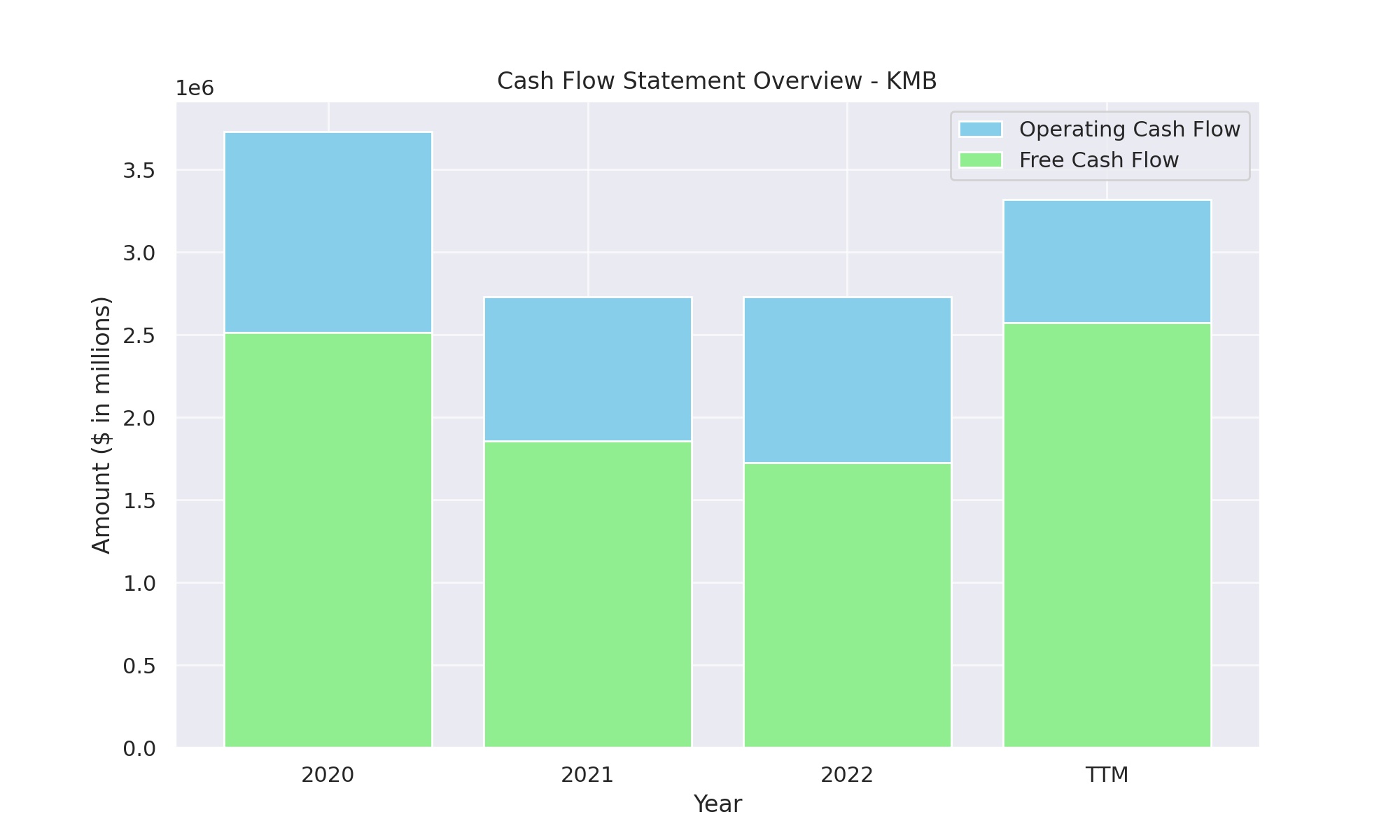

Cash Flow Statement Analysis

The company’s cash flow statement for the trailing twelve months serves as a financial barometer, and the readings suggest fair weather ahead with operating cash flow gusting in at $3,318,000. This is a welcome breath of fresh air after the previous year’s $2,733,000, hinting that the company’s operations are inhaling efficiency and exhaling profitability. The breath of this financial wind is strong enough to turn the turbines of growth, albeit not quite hurricane force.

Investing cash outflows have been pruned back to $534,000, a figure that’s less thorny than the prior year’s $785,000, suggesting that the company might be planting seeds for future growth with a more conservative hand. Meanwhile, the financing cash flow has trickled out to the tune of $2,271,000, reflecting a streamlining of debts or payouts to shareholders. Like a responsible dieter avoiding carbs, the company seems to be cutting down on its capital expenditures, which have slimmed down to $746,000. The end cash position plumped up to $875,000, might not be a feast, but it’s certainly not crumbs either. In the grand kitchen of commerce, the company appears to be cooking up a strategy that keeps the cash simmering on the back burner, ready for whatever recipe the market demands next.

SWOT Analysis

A SWOT analysis for Kimberly-Clark Corporation (KMB) could highlight the following factors:

Strengths:

- Established Market Position: KMB has a strong presence in the personal care industry with a broad portfolio of well-known brands such as Huggies and Kleenex.

- Global Reach: With operations in more than 175 countries, the company benefits from geographical diversification.

- Innovation: A focus on product innovation helps to meet changing consumer preferences and maintain market share.

Weaknesses:

- Product Recall Risks: As with any company in the personal care space, product recalls due to quality issues can lead to financial loss and brand damage.

- Dependence on Retailers: A substantial portion of sales comes from a few large retailers, which could be a risk if relationships deteriorate.

Opportunities:

- E-Commerce Growth: There is an opportunity to expand sales through online channels, which have seen significant growth.

- Sustainability Initiatives: Increasing consumer preference for eco-friendly products presents an opportunity for KMB to expand its sustainable product line.

- Emerging Markets: There is potential for growth in emerging markets where the penetration of personal care products is still growing.

Threats:

- Intense Competition: The industry is highly competitive, with several large players vying for market share.

- Raw Material Costs: Fluctuations in the price of raw materials can impact profit margins.

- Regulatory Changes: Stringent regulations can increase operational costs or limit market access.

Kimberly-Clark’s SWOT analysis underscores its solid market standing and expansion opportunities, particularly in digital sales and sustainable products. However, it must carefully navigate operational risks and intense competition to maintain and grow its market position.