Leggett & Platt, Incorporated (LEG) stands as a testament to enduring corporate resilience and strategic financial management within the diversified manufacturing sector. Founded in 1883 and headquartered in Carthage, Missouri, LEG has grown into a leading innovator and manufacturer of a wide range of engineered products that find critical applications across various industries, including residential furniture, commercial seating, bedding, automotive, and more. The company’s commitment to innovation, sustainability, and customer satisfaction has been pivotal in its ability to navigate the complexities of global markets successfully.

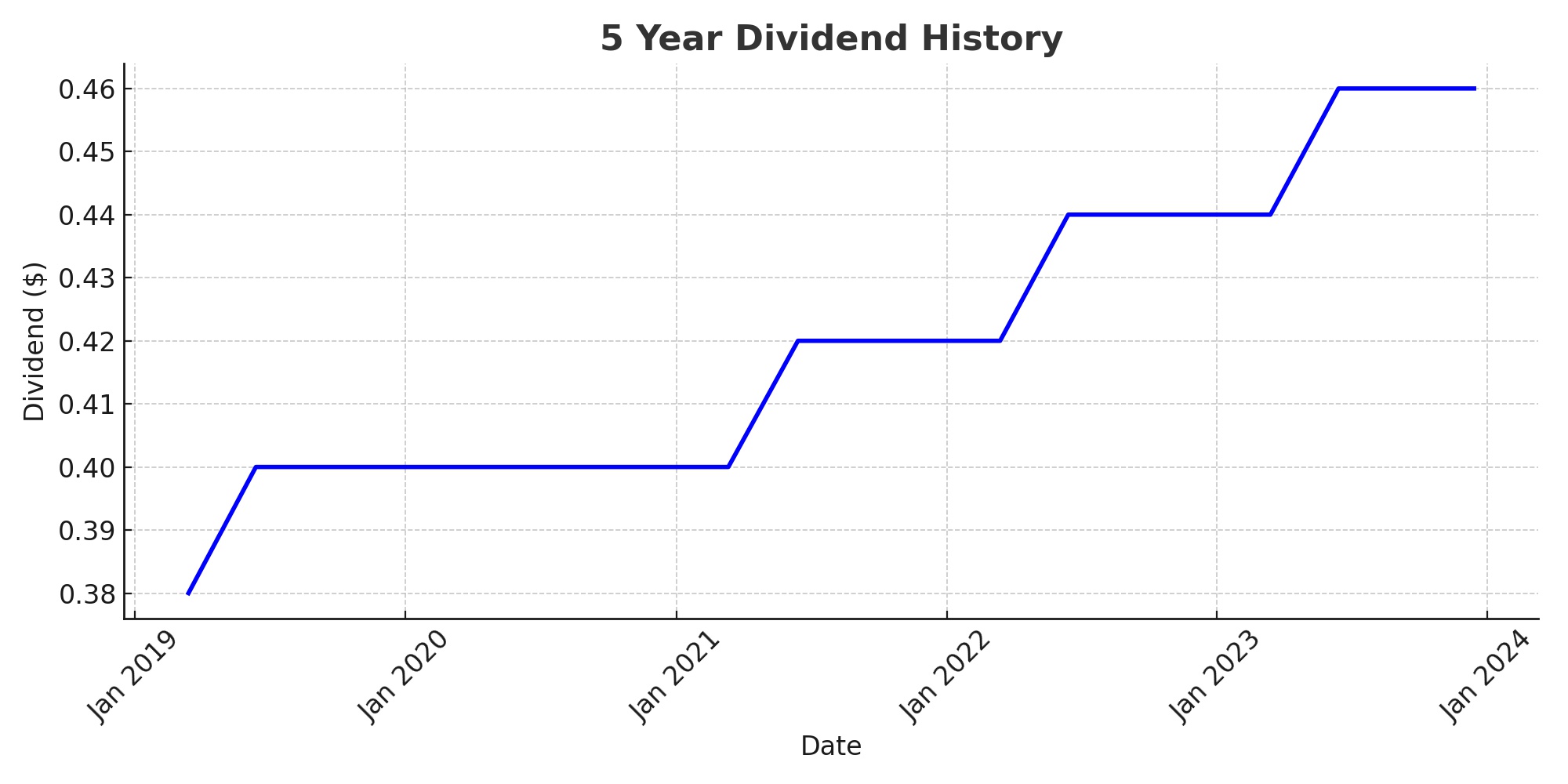

A hallmark of Leggett & Platt’s financial prudence and shareholder commitment is its impressive track record of increasing dividends for 51 consecutive years, earning it the prestigious title of a Dividend King. This remarkable achievement highlights LEG’s operational efficiency, robust cash flow generation, and a well-balanced approach to capital allocation. The company’s ability to consistently increase dividends reflects not only its financial health but also its dedication to delivering long-term value to its shareholders, underscoring its status as a stalwart in the investment community.

Analyst Ratings

Recent analyst ratings for the stock have shown a mix of caution and optimism, with adjustments in price targets reflecting varying views on the company’s future performance. Keith Hughes of Truist Securities has adjusted his price target three times over the recent months, with the latest on November 1, 2023, setting it at $24, down from $26, suggesting a modest upside of +4.64%. This followed earlier reductions from $35 to $31 in August and then to $26 in October, indicating a progressively cautious outlook on the stock’s valuation.

Peter Keith of Piper Sandler maintains a more bearish stance, holding onto a “Sell” rating and lowering the price target from $21 to $18 on November 1, 2023. This adjustment indicates a significant anticipated downside of -21.52%, pointing to concerns about the stock’s potential to sustain its current market price.

On a slightly more optimistic note, Susan Maklari of Goldman Sachs also adjusted her price target on November 1, 2023, aligning with Hughes’ latest target of $24, down from $27. This adjustment suggests a belief in a modest upside potential of +4.64%, mirroring Hughes’ assessment and indicating a consensus among some analysts about the stock’s moderate growth prospects.

Overall, these ratings and adjustments reflect a cautious but not wholly pessimistic view of the stock’s future market performance, with a range of expectations on price targets and potential upsides or downsides. The adjustments suggest ongoing reassessment of the company’s valuation in light of market conditions and company performance.

Insider Trading

We didn’t find any recent insider buying or selling.

Dividend Metrics

Leggett & Platt, Incorporated (LEG) has a notable history of dividend reliability, having increased its dividend for 51 consecutive years. This consistency underscores its inclusion in the esteemed group of Dividend Kings, marking a long-term commitment to shareholders. The stock currently offers a substantial yield of 7.69%, which is significantly higher than its 5-year average yield of 4.46%. This high yield may reflect the stock’s price decrease, as the 1-year return stands at a substantial loss of -36.79%.

The dividend growth over the past five years averages to 4.26%, indicating a steady rise in dividend payments. However, the company has faced challenges, as reflected by a 1-year revenue decline of -9.20%. Additionally, the payout ratio has reached 114%, which typically suggests that the company is paying out more in dividends than it is earning. This could raise concerns about the sustainability of such high dividend payments in the absence of adequate earnings or the use of reserves or debt to maintain the dividend policy. The comparison of the current yield to the average also suggests volatility in the stock price or changes in the dividend policy over the recent years.

Dividend Value

Leggett & Platt, Incorporated (LEG) presents a current dividend yield of 7.69%, a figure that stands out when juxtaposed with its 5-year average yield of 4.46%. This pronounced increase in yield could potentially signal a more attractive valuation for income-focused investors, hinting that the stock might be undervalued if we consider the dividend yield in isolation.

The disparity between the current yield and its historical average suggests that the stock’s price has decreased relative to the dividends paid, which could be due to market adjustments or sector-specific headwinds. For those with an eye for yields that outpace historical averages, LEG may appear as an intriguing canvas, inviting a closer inspection to paint a full picture of its intrinsic value. Investors would be wise, however, to color within the lines of due diligence, as a higher than average yield could also reflect underlying market concerns about the company’s future growth or profitability that are not immediately evident.

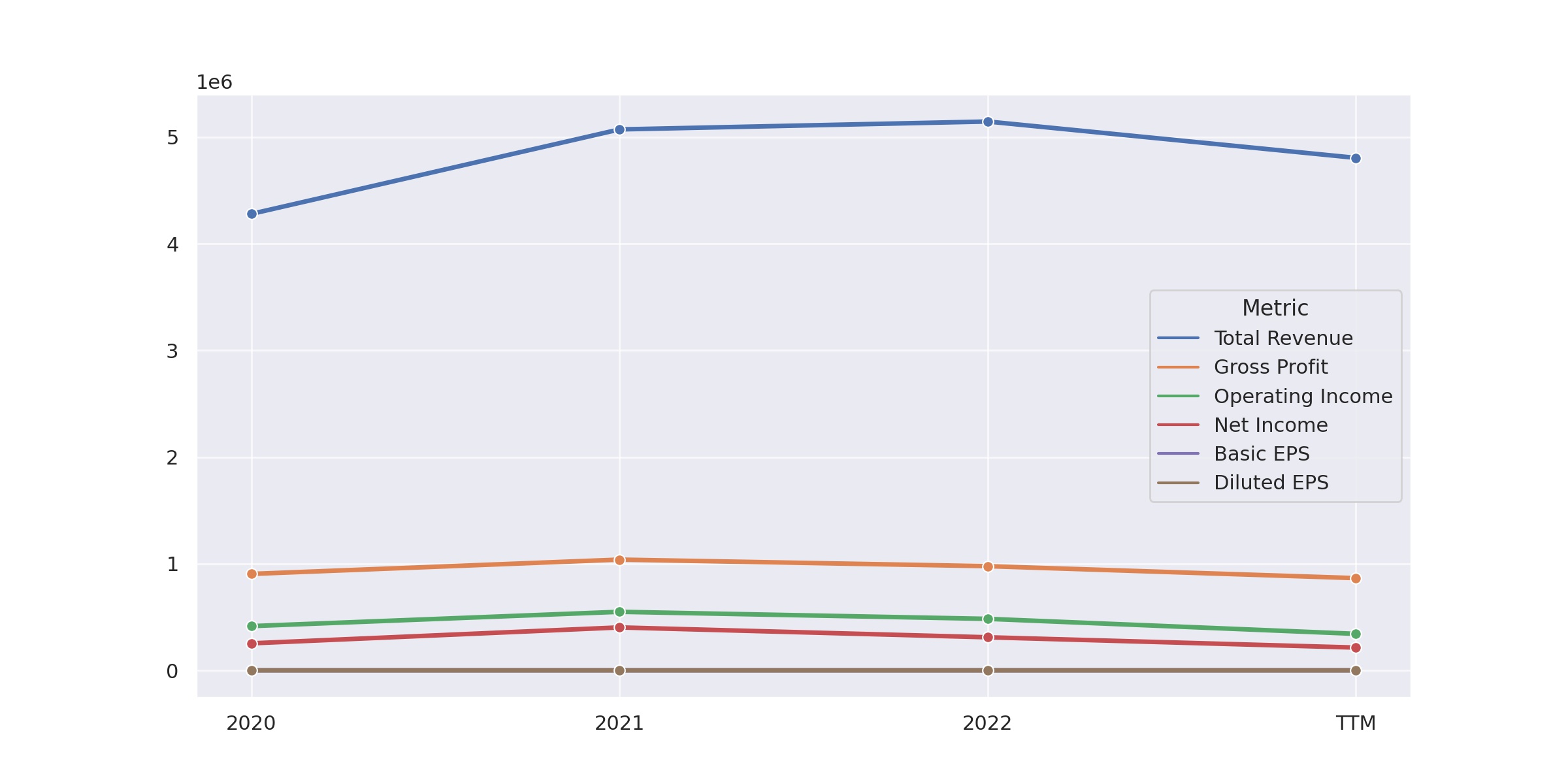

Income statement Analysis

The income statement of our mysterious entity paints a picture of a fiscal odyssey, not unlike the journey of a paper airplane in a hurricane. Total revenue, the captain of this paper vessel, has seen stormier days, dipping from $5,146,700 to $4,806,000 in the trailing twelve months (TTM). This tempestuous ride suggests that sales might have hit a bit of turbulence, leaving the gross profit to buckle its seatbelt at $864,600, a descent from the more comfortable altitude of $976,800 the year before.

Descending to the land of operating expenses, which seems to have taken a modest sip of the elixir of growth, increasing to $522,500 in the TTM from the $494,100 in the previous year. This has nudged the operating income to tighten its belt from $482,700 to $342,100. It seems the net non-operating interest income expense has been playing a game of financial limbo, seeing how low it can go, reaching -$85,700. After settling all scores with tax provisions, the net income available to common stockholders landed with a soft thud at $213,300, a figure that may cause the bean counters to reminisce about the golden days of $309,800. Through it all, basic and diluted EPS have hummed a similar tune, maintaining a harmony at $1.57, which is somewhat off-key compared to last year’s melody.

Balance sheet Analysis

In the fiscal theater, our protagonist, Total Assets, has been performing a subtle vanishing act, descending from $5,307,300 to a more modest $5,186,100. Like a magician’s assistant, Total Liabilities Net Minority Interest has followed suit, but with less flair, slipping from $3,658,700 to $3,544,700. Equity, on the other hand, seems to have decided that consistency is key, holding almost steady with a slight dip from $1,648,600 to $1,641,400, defying the gravity of financial ebbs and flows. This act of balance, not quite as thrilling as walking a tightrope but equally precarious, has kept the Total Capitalization relatively stable, a nod to the company’s steady hand on the financial rudder.

Diving into the deep end of the balance sheet, Net Tangible Assets have decided that going negative is the new black, fashionably sporting -$509,100, just a smidge less than the previous year’s trend of -$509,400. This bold choice might leave some investors questioning the style choice. Working Capital, the industrious understudy, has made a notable entrance, stepping up from $729,600 to $989,900, ready to take on the current liabilities in a fiscal duel. Meanwhile, Total Debt has been lifting weights, bulking up to $2,286,700, perhaps in an attempt to impress the capital structure analysts. As for the Ordinary Shares Number, it remains a beacon of stability in a sea of fluctuating figures, providing a comforting sense of familiarity amidst the drama of the other numbers.

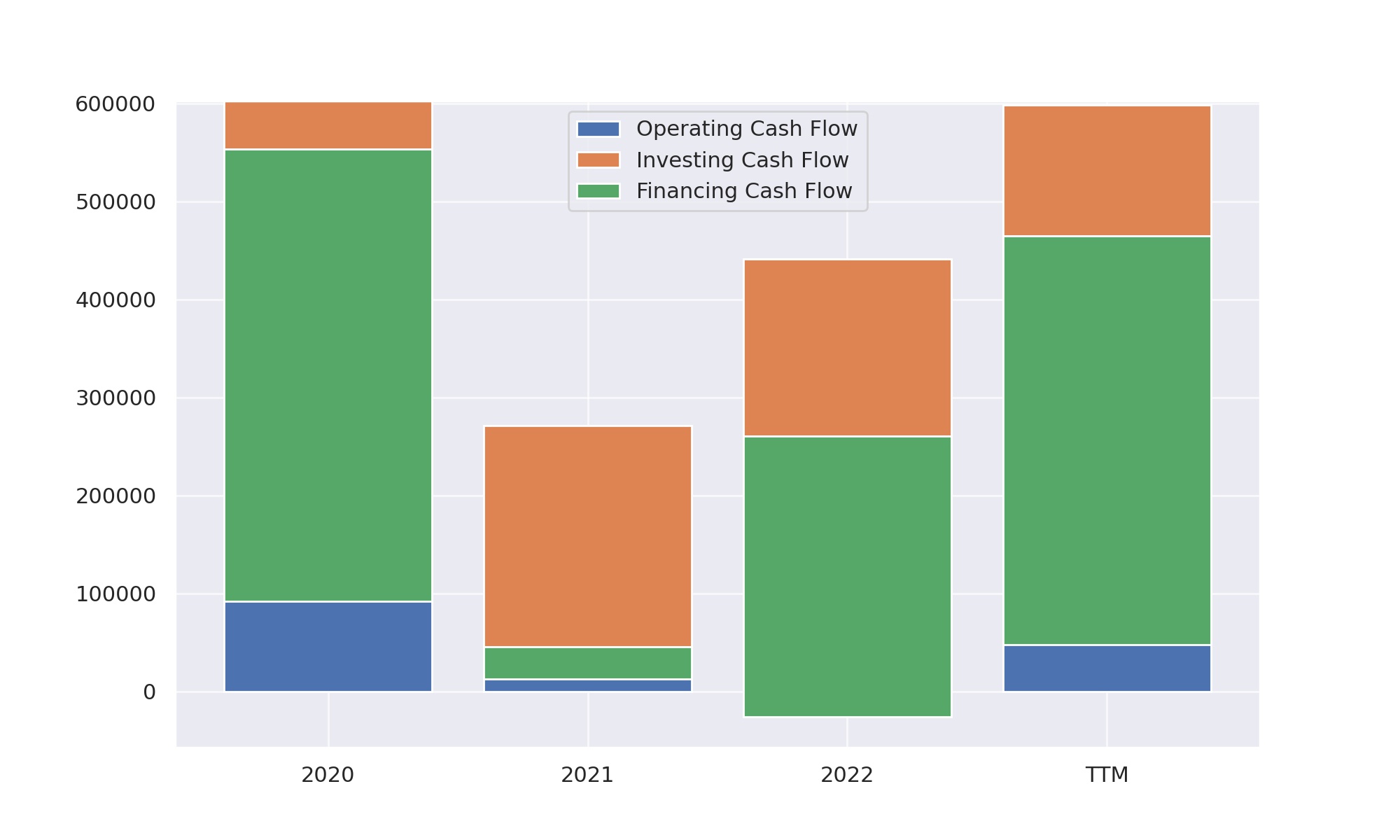

Cash Flow Statement Analysis

In the realm of cash flow, the plot thickens as the Operating Cash Flow plays the part of the main character, with a performance that’s more of a comeback story than a consistent saga. After an opening act of $602,600, it took a dramatic pause down to $271,300, only to climb back up to $598,200 in the TTM, showing it has the stamina of a marathon runner with a penchant for surprising sprints. Investing Cash Flow, the antagonist with a penchant for the dramatic exit, has persisted in its negative role, digging a deeper scene each year, from a mild – $49,000 to an emphatic – $133,200. This part of the plot hints at a strategy that’s always shopping but never quite satisfied with the purchase.

Financing Cash Flow seems to have taken a vow of minimalism, streamlining its figures with a strict budget that went from an outflow of – $461,700 to a slightly less austere – $417,700, suggesting perhaps a more conservative approach to debt and equity maneuvers. Meanwhile, the End Cash Position, playing the part of the steady sidekick, ended with a modest $273,500, a slight dip that might leave some wondering if it’s planning a new adventure or just taking a breather. Free Cash Flow, the unsung hero, swung from a healthy $536,400 to $473,000, proving that even in the financial world, free things (or almost free cash flows) come with their own set of fluctuations.

SWOT Analysis

Creating a SWOT analysis for Leggett & Platt, Incorporated (LEG), involves examining the company’s internal strengths and weaknesses, along with external opportunities and threats it faces in the industry. Leggett & Platt is a diversified manufacturer of engineered components and products found in most homes and automobiles, with a long history dating back to 1883. Here’s a focused SWOT analysis based on its operational and strategic positioning up to early 2023:

Strengths:

- Diversified Product Portfolio: LEG operates across multiple segments, including Residential Products, Industrial Products, Furniture Products, and Specialized Products, reducing its dependence on any single market.

- Innovation and Patents: A strong focus on innovation, backed by a significant portfolio of patents, helps LEG maintain a competitive edge and drive product development.

- Dividend King: With over 50 years of consecutive dividend increases, LEG demonstrates financial stability and commitment to shareholder value, a significant strength in attracting and retaining investors.

Weaknesses:

- Market Sensitivity: LEG’s performance is closely tied to the housing and automotive markets, making it vulnerable to downturns in these industries.

- Competition: The company faces stiff competition in all its operational sectors, which can pressure margins and market share, particularly from lower-cost international manufacturers.

Opportunities:

- Expansion in Emerging Markets: There are significant opportunities for growth in emerging markets, where increasing consumer spending and urbanization drive demand for products in LEG’s portfolio.

- E-commerce and Direct-to-Consumer Sales: Expanding online sales channels could open new revenue streams and increase profit margins by reducing reliance on traditional brick-and-mortar retailers.

- Sustainability and Eco-Friendly Products: Increasing consumer demand for sustainable and environmentally friendly products presents an opportunity for LEG to innovate and lead in green manufacturing processes and materials.

Threats:

- Raw Material Price Volatility: Fluctuations in the prices of raw materials such as steel and aluminum can impact LEG’s cost of goods sold and overall profitability.

- Economic Downturns: Economic recessions or slowdowns in key markets (e.g., housing and automotive) can significantly affect demand for LEG’s products.

- Regulatory Changes: Changes in trade policies, tariffs, and environmental regulations could increase operational costs or affect LEG’s competitive position in international markets.

This SWOT analysis highlights that Leggett & Platt’s diversified operations and commitment to innovation and shareholder value are foundational strengths. However, navigating the challenges of market sensitivity, competition, and external economic factors will be crucial for sustaining growth and leveraging opportunities in emerging markets and new sales channels.

Competitors

Leggett & Platt, Incorporated (LEG), a diversified manufacturer of engineered products and components, operates in a competitive landscape characterized by a variety of players in the furniture, bedding, automotive, and industrial materials sectors. Here’s a summary of LEG’s top five competitors, based on their industry presence, product offerings, and market strategies:

- Tempur Sealy International, Inc. (TPX): As one of the largest bedding providers globally, Tempur Sealy represents significant competition to LEG in the bedding products market. With a strong portfolio of brands, including Tempur-Pedic, Sealy, and Stearns & Foster, Tempur Sealy offers a wide range of mattresses and bedding accessories, competing directly with LEG’s bedding components.

- Serta Simmons Bedding, LLC: Another major player in the bedding industry, Serta Simmons Bedding combines two of the most iconic brands in mattresses, Serta and Simmons. Their extensive product line and distribution network pose competitive pressure on LEG, particularly in the U.S. market.

- Ashley Furniture Industries: The largest furniture manufacturer in the world, Ashley Furniture competes with LEG in the furniture components sector. Ashley’s comprehensive range of products, from home furnishings to decor, challenges LEG’s furniture-related segments.

- Flexsteel Industries, Inc. (FLXS): Specializing in a broad range of furniture products, including seating, Flexsteel serves residential, commercial, and recreational vehicle markets. Their focus on quality and design places them as a noteworthy competitor to LEG’s furniture solutions.

- Steelcase Inc. (SCS): As a leader in the office furniture market, Steelcase offers innovative and sustainable furniture solutions that compete with LEG’s offerings in the commercial and office segment. Steelcase’s global reach and commitment to research and design innovation make it a formidable competitor.