Lowe’s Companies, Inc. (LOW) is a prominent American retail company specializing in home improvement. Founded in 1946, it has grown to become the second-largest hardware chain in the United States and globally. Lowe’s operates or services a chain of retail stores across the United States and Canada, offering a wide variety of products for construction, maintenance, repair, remodeling, and decorating. The company is known for its commitment to providing quality home improvement goods and services at competitive prices, catering to both individual homeowners and professional customers.

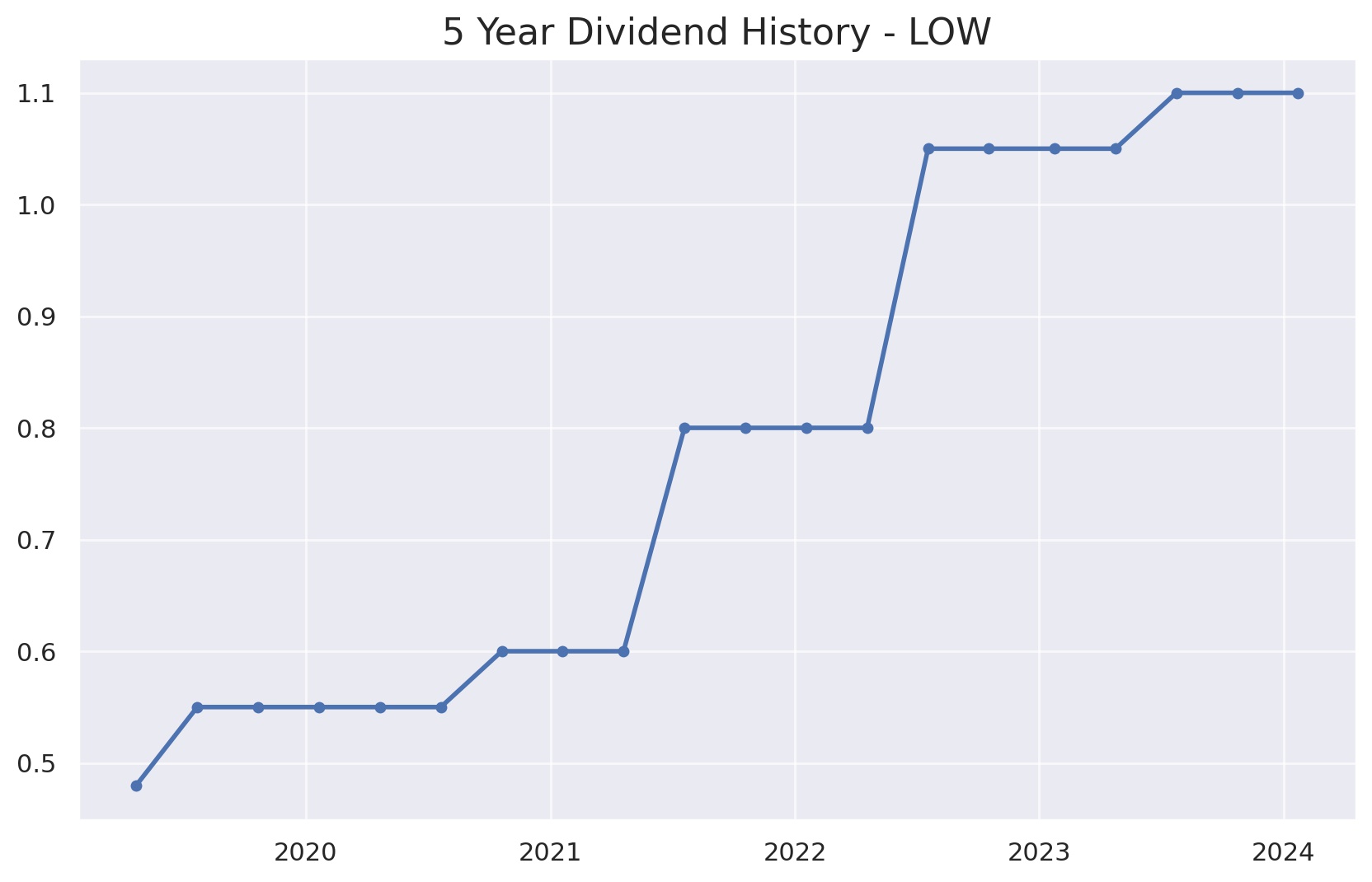

A standout feature of Lowe’s financial performance is its remarkable record of increasing dividends for 60 consecutive years, positioning it among the elite group known as the Dividend Kings. This group comprises companies with a history of raising their dividends for at least 50 consecutive years, underscoring Lowe’s strong financial health, stability, and commitment to returning value to its shareholders. The company’s ability to consistently increase its dividend over such a long period is a testament to its operational excellence, strategic growth initiatives, and resilience in various economic conditions.

Analyst Ratings

Recent analyst ratings for Lowe’s Companies, Inc. (LOW) show a mixed but generally positive outlook from various firms, with adjustments to ratings and price targets reflecting analysts’ evolving views on the company’s stock performance potential.

- Peter Keith from Piper Sandler maintains a Buy rating and increased the price target from $218 to $245, suggesting a +12.38% upside as of January 16, 2024.

- Seth Sigman of Barclays holds a rating of Hold, with the price target raised from $203 to $229, indicating a +5.04% upside as of January 4, 2024.

- Scot Ciccarelli from Truist Securities gives a Strong Buy rating, adjusting the price target up from $225 to $252, which translates to a +15.59% upside as of December 21, 2023.

- W. Andrew Carter at Stifel downgraded LOW from Strong Buy to Hold, with a slight price target increase from $235 to $240, marking a +10.09% upside as of December 20, 2023.

- Steven Shemesh from RBC Capital maintains a Hold rating but reduced the price target from $194 to $190, indicating a -12.85% downside as of November 27, 2023.

These ratings indicate a broad recognition of Lowe’s growth potential and operational strengths, albeit with cautious optimism and some concerns, as reflected in the varied price target adjustments and ratings actions.

Insider Trading

Analyzing the insider buy and sell transactions for Lowe’s Companies, Inc. (LOW) over the last 6-12 months, focusing solely on buy and sell activities (excluding awards and transfers), reveals a pattern of insider sales following exercise of options, which is common in corporate environments as insiders manage their investment and compensation packages. There are no outright purchase transactions listed, indicating all reported transactions are sales post-exercise or direct sales, which may reflect insiders capitalizing on the stock’s performance or part of their compensation strategy. Here’s a summary of key transactions:

- High-Volume Sales: The transactions with the highest volumes include Marvin R. Ellison (Chair & CEO) selling 61,271 shares at $199.97 each on April 1, 2023, and William P. Boltz (Div. EVP) selling 23,000 shares at $203.00 each on May 25, 2023. These large sales could reflect significant compensation events or strategic portfolio adjustments.

- Notable Price Points: The highest sale price was by Janice Dupre Little (CHRO), who sold 5,380 shares at $231.28 each on August 31, 2023. This suggests that insiders are taking advantage of higher price points to realize gains.

- Frequent Sellers: Several insiders appear multiple times in the transaction list, indicating regular participation in the company’s stock option exercise and sale program. For example, William P. Boltz and Janice Dupre Little conducted several transactions across the period, aligning with typical executive compensation practices.

- Post-Exercise Sales: Most transactions are labeled as “Sale Post-exercise,” indicating insiders are exercising options and immediately selling shares, a common practice to mitigate risk and diversify assets.

- Overall Activity Trend: The bulk of the sales occurred in a context where insiders are likely managing their equity compensation, rather than signaling a lack of confidence in the company’s future performance. The absence of outright buys outside of award exercises might suggest that insiders are not actively purchasing additional shares on the open market, but this is not uncommon and not necessarily a negative indicator.

This summary indicates a pattern of insider sales that align with standard practices of exercising options and selling shares, rather than direct market purchases or sales indicating insider sentiment towards the company’s future prospects.

Dividend Metrics

Lowe’s Companies, Inc. (LOW) has a distinguished track record in the market, evidenced by its financial indicators. The company has a remarkable history of dividend growth, with dividends increasing for 60 years, reflecting a strong and consistent return to shareholders. The dividend yield is currently at 2.05%, showing the income that investors earn in relation to the stock price. Over the last five years, the dividend has grown by 17.98%, indicating a significant upward trend in the dividends paid to investors.

In terms of revenue, Lowe’s has seen a decrease of 12.80% over the past year, signaling a downturn in total revenue. Despite this, the company maintains a healthy payout ratio of 32%, suggesting that it retains most of its earnings for reinvestment while still providing a share to its investors as dividends. The average dividend yield over the past five years stands at 1.68%, offering insight into the historical yield performance. Finally, the stock has delivered a 0.45% return over the last year, which points to a stock that has remained relatively stable with a marginal positive return during this period. These figures collectively highlight Lowe’s as a dividend-reliable company with a cautious approach to growth and shareholder returns.

Dividend Value

Lowe’s Companies, Inc. (LOW) presents an interesting value proposition when its current dividend yield of 2.05% is compared to its 5-year yield average of 1.68%. This indicates that the stock is offering a higher income return for investors at the current price compared to the average over the past five years.

Typically, a higher current yield can suggest that a stock is undervalued if we assume that dividends are a reliable indicator of a company’s financial health and are not expected to change significantly. The fact that the current yield surpasses the average points to the possibility that the stock’s price has not appreciated at the same pace as its dividend growth, or the market has not fully recognized the company’s earning potential relative to its historical performance. For income-focused investors, this could signal an opportunity, as the stock is yielding more than what has been typical, potentially offering both income and capital appreciation if the market adjusts to recognize this yield discrepancy.

Income statement Analysis

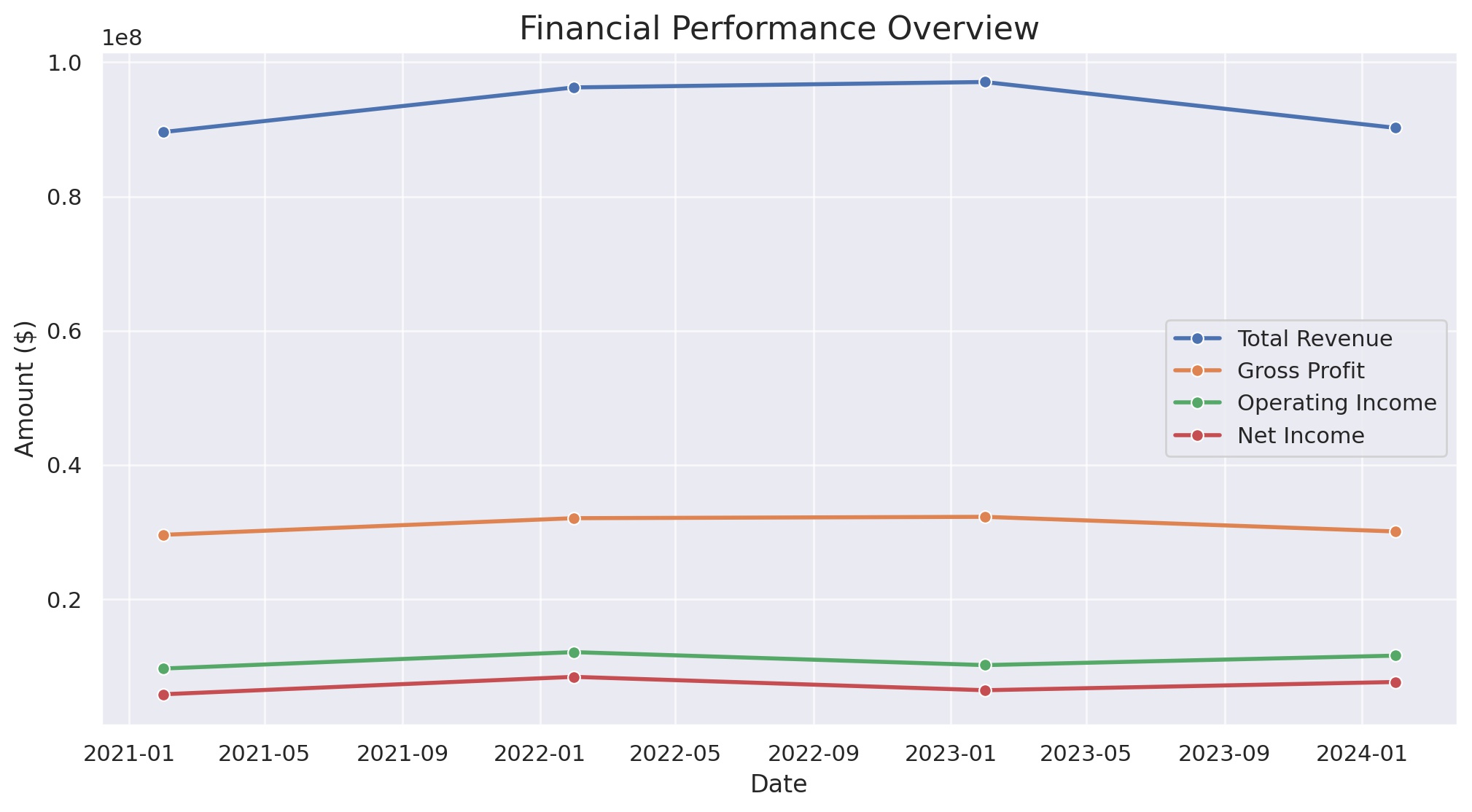

Over the past four years, Lowe’s Companies, Inc. has seen its total revenue scale a modest financial summit of $97,059,000 in 2022 before taking a slight dip to $90,220,000 in the trailing twelve months (TTM), as if it decided to take a breather. Cost of revenue saw a parallel journey, peaking in 2022 at $64,802,000, only to relax a bit to $60,146,000 in the TTM. Gross profit, mirroring this trend, climbed to a comfortable ledge at $32,257,000 in 2022 but then chose to camp at the lower altitude of $30,074,000 in the TTM. It seems even the figures prefer a change of scenery now and then.

Operating expenses and operating income have danced an interesting tango over the years, with operating expenses stepping back from a high of $22,098,000 in 2022 to $18,501,000 in the TTM, allowing operating income to take the lead with a rise to $11,573,000 from $10,159,000. Net income available to common stockholders didn’t want to miss out on the fun, boogieing up from $6,416,000 in 2022 to a groovier $7,642,000 in the TTM. It’s not all smooth moves, though; the Basic and Diluted EPS figures did a slight shuffle, with the former tapping up from 10.20 to 13.07 and the latter from 10.17 to 13.04, likely humming a tune of cautious optimism.

Balance sheet Analysis

Lowe’s Companies, Inc.’s balance sheet has taken a dive into the negative equity territory, with total equity gross minority interest plunging from a mountaintop of $1,437,000 in 2021 to a submarine level at -$14,254,000 in 2023. It’s not quite the treasure chest one might hope to find at the bottom of the ocean. Total assets have seemingly taken a modest step back in the tango of finance, stepping down from $46,735,000 in 2021 to $43,708,000 in 2023, perhaps shyly making room on the dance floor for liabilities which have ballooned to $57,962,000 in the same period.

On the debt stage, total debt has cranked up the volume, rocking out at $37,994,000 in 2023, up from $26,211,000 in 2021. Meanwhile, net debt has followed suit, rising like a hot air balloon from $17,090,000 to $32,612,000. Despite the increase in debt, working capital seems to be doing its own thing, hanging out at $1,931,000 in 2023, a bit more relaxed compared to its previous year’s figure. As for tangible book value, it’s sticking to its negative script, mirroring the equity’s retreat into the red zone. Common stock equity has also echoed this sentiment, taking cues from total equity’s script. It’s clear that the balance sheet’s performance would have been more warmly received if it were a dramatic play rather than a financial statement.

Cash Flow Statement Analysis

Lowe’s Companies, Inc. seems to be on a financial diet, with its operating cash flow slimming down from a hearty $11,049,000 in 2021 to a more svelte $7,483,000 in the TTM. Maybe the company decided it was time to trim the excess after reaching a cash flow peak, or perhaps the economic winds blew a little less favorably. Investing cash flow is consistently in the red, though it appears the company took a less aggressive stance in the TTM with outflows of only $1,500,000, as if it decided to be a bit more frugal with its investment calories after a spending spree the previous years.

The financing cash flow narrative has flipped from perhaps overspending on a credit card to paying it down, revealing a tale of – $7,981,000 in the TTM, a notable change from the – $5,191,000 seen in 2021. It’s like the company decided to sober up after a heady party of spending. Meanwhile, the end cash position has been on a downward trek from a plush $4,690,000 mountain of cash in 2021 to a more pedestrian $1,194,000, possibly after some fiscal soul searching. It’s not the kind of ‘running out of cash’ horror story that keeps CFOs up at night, but it might make them double-check their financial flashlights.

SWOT Analysis

A SWOT analysis for Lowe’s Companies, Inc. (LOW) provides a comprehensive overview of its strengths, weaknesses, opportunities, and threats in the competitive home improvement retail market.

Strengths:

- Brand Recognition: Lowe’s is a well-established brand with a strong market presence in the home improvement industry, attracting a loyal customer base.

- Wide Product Range: The company offers a broad assortment of products for homeowners, renters, and professional customers, catering to a wide range of home improvement needs.

- Operational Efficiency: Lowe’s has a robust supply chain and efficient inventory management systems, ensuring product availability and timely delivery.

- Financial Health: With consistent dividend growth and solid financial performance, Lowe’s demonstrates financial stability and the ability to invest in growth initiatives.

Weaknesses:

- Competition: Intense competition from other big-box retailers and online platforms could impact market share and pricing strategies.

- Dependence on the U.S. Market: Although expanding, Lowe’s is still heavily reliant on the U.S. market, making it susceptible to regional economic fluctuations.

- Limited Global Presence: Compared to some competitors, Lowe’s has a limited presence outside North America, restricting its growth potential in emerging markets.

Opportunities:

- E-Commerce Expansion: Investing in online sales platforms and omnichannel retailing could capture a larger share of the rapidly growing online home improvement market.

- Global Expansion: Exploring markets outside North America offers the potential for growth, diversifying its revenue sources.

- Sustainable and Smart Home Products: Increasing demand for eco-friendly, sustainable, and smart home products presents an opportunity for Lowe’s to expand its product lines in these categories.

- Partnerships and Acquisitions: Strategic partnerships or acquisitions could provide new customer segments, technologies, or operational capabilities.

Threats:

- Economic Downturns: Economic slowdowns can significantly reduce consumer spending on home improvement projects, affecting sales.

- Supply Chain Disruptions: Global supply chain issues can lead to stock shortages and increased costs, impacting profitability.

- Changing Consumer Preferences: Rapid changes in consumer tastes and a shift towards do-it-for-me (DIFM) services over do-it-yourself (DIY) could challenge Lowe’s traditional business model.

- Regulatory Changes: Environmental regulations and labor laws could increase operational costs or require significant adjustments to business practices.

This SWOT analysis highlights Lowe’s position as a strong player in the home improvement sector while also pointing out areas where strategic adjustments could foster growth and mitigate risks.

Competitors

Lowe’s Companies, Inc. (LOW), a leading home improvement retailer, operates in a competitive landscape characterized by both brick-and-mortar stores and online platforms. Here are its top 5 competitors:

- The Home Depot, Inc. (HD): Home Depot is the largest home improvement retailer in the United States, making it Lowe’s primary and most direct competitor. It offers a wide range of products and services for DIY and professional customers. Home Depot’s expansive store network and strong online presence pose significant competition to Lowe’s in terms of market share and customer loyalty.

- Menards: A privately-held company, Menards is another significant competitor in the home improvement retail sector, primarily located in the Midwest. It is known for its wide selection of items for home improvement, building materials, and lawn and garden products, catering to both the DIY and professional contractor markets.

- Ace Hardware Corporation: As a cooperative of independently owned stores, Ace Hardware offers a more localized shopping experience, which competes with Lowe’s in terms of convenience and customer service. Ace Hardware serves a segment of the market that prefers a neighborhood hardware store to a large big-box format.

- True Value Company: Similar to Ace Hardware, True Value is a cooperative that provides members with the buying power of a larger corporate entity while allowing for local ownership and operation. True Value competes by focusing on personalized customer service and community involvement, appealing to customers looking for a more personal touch in their shopping experience.

- Amazon.com, Inc. (AMZN): While not a traditional home improvement retailer, Amazon’s vast online platform makes it a formidable competitor to Lowe’s, especially in the realm of tools, home improvement products, and smart home devices. Amazon’s convenience, competitive pricing, and rapid delivery options challenge traditional retailers like Lowe’s, particularly among younger, tech-savvy consumers.