National Fuel Gas (NFG), established in 1902 and headquartered in Williamsville, New York, stands out as a remarkable example of longevity and reliability in the energy sector, having increased its dividend for 52 consecutive years. This achievement places NFG among the prestigious group known as the Dividend Kings, a testament to its enduring commitment to shareholder value.

The company’s diversified operations span exploration and production, pipeline and storage, gathering, utility, and energy marketing, showcasing a robust business model that has sustained its growth and resilience over the years. Notably, NFG’s innovation in using depleted underground gas fields for storage marked a significant advancement in the industry, further highlighting its pioneering spirit and operational excellence.

Analyst Ratings

- Cameron Bean from Scotiabank upgraded the stock from Hold to Buy, setting a price target of $68, suggesting a significant potential upside of 47.44% as of September 14, 2023. This upgrade indicates a positive shift in the stock’s outlook.

- David Coleman of Argus Research maintained a Strong Buy rating but reduced the price target from $76 to $58 on May 24, 2023. Despite the decrease, the new target still implies a 25.76% upside, showing optimism albeit with adjusted expectations.

- Brian Singer at Goldman Sachs kept a Hold rating, adjusting the price target down from $60 to $54 on May 24, 2023. This revision suggests a modest 17.09% upside, indicating a cautious but not pessimistic view on the stock’s future performance.

- John Freeman of Raymond James downgraded the stock from Buy to Hold on February 6, 2023, without specifying a new price target. This change reflects a shift towards a neutral stance on the stock’s prospects.

- Earlier, on January 26, 2023, John Freeman had maintained a Buy rating but lowered the price target from $78 to $65, projecting a 40.94% upside. This adjustment indicates a positive but moderated outlook compared to previous expectations.

Overall, the analyst ratings for the stock show a mix of optimism and caution. Upgrades and maintained strong buy ratings suggest confidence in the stock’s potential, while downgrades and lowered price targets indicate a tempering of expectations. The significant potential upsides noted by analysts, even with some price target reductions, highlight a generally positive outlook on the stock’s growth potential.

Insider Trading

Over the past 6-12 months, National Fuel Gas (NFG) has seen a mix of insider transactions, focusing on buy and sell activities:

- On December 10, 2023, Donna Decarolis, a Division President, sold 1,054 shares at a price of $50.735 each, totaling $53,475. After the sale, Decarolis held 115,601 shares, representing 0.1259% of the company’s holdings.

- Elena G Mendel, a Controller, sold 252 shares at the same price on December 10, 2023, for a total of $12,785, with her holdings afterward totaling 16,403 shares, or 0.0179%.

- Michael W Reville, General Counsel, also engaged in a sale post-exercise transaction on December 10, 2023, selling 300 shares at $50.735 each, totaling $15,221. His remaining shares totaled 30,104, accounting for 0.0328% of the company’s holdings.

- On December 6, 2023, several executives engaged in significant transactions. Notably, David P Bauer, the CEO, sold 2,459 shares at a price of $50.325 each, amassing $123,750. After this transaction, Bauer’s holdings were 88,807 shares, making up 0.0967% of the company.

- Ronald C Kraemer, the COO, sold 909 shares at the same price on December 6, 2023, for a total of $45,745, with his post-transaction shares totaling 68,751, or 0.0749% of the company’s shares.

- Additionally, on December 6, 2023, Justin I Loweth, a Division President, sold 3,274 shares at $50.325 each, collecting $164,764, with his holdings afterward being 68,681 shares or 0.0748% of the company.

These transactions show a mix of strategic sales post-exercise, indicating active management of personal investment portfolios within the regulatory and compliance frameworks guiding insider trading.

Dividend Metrics

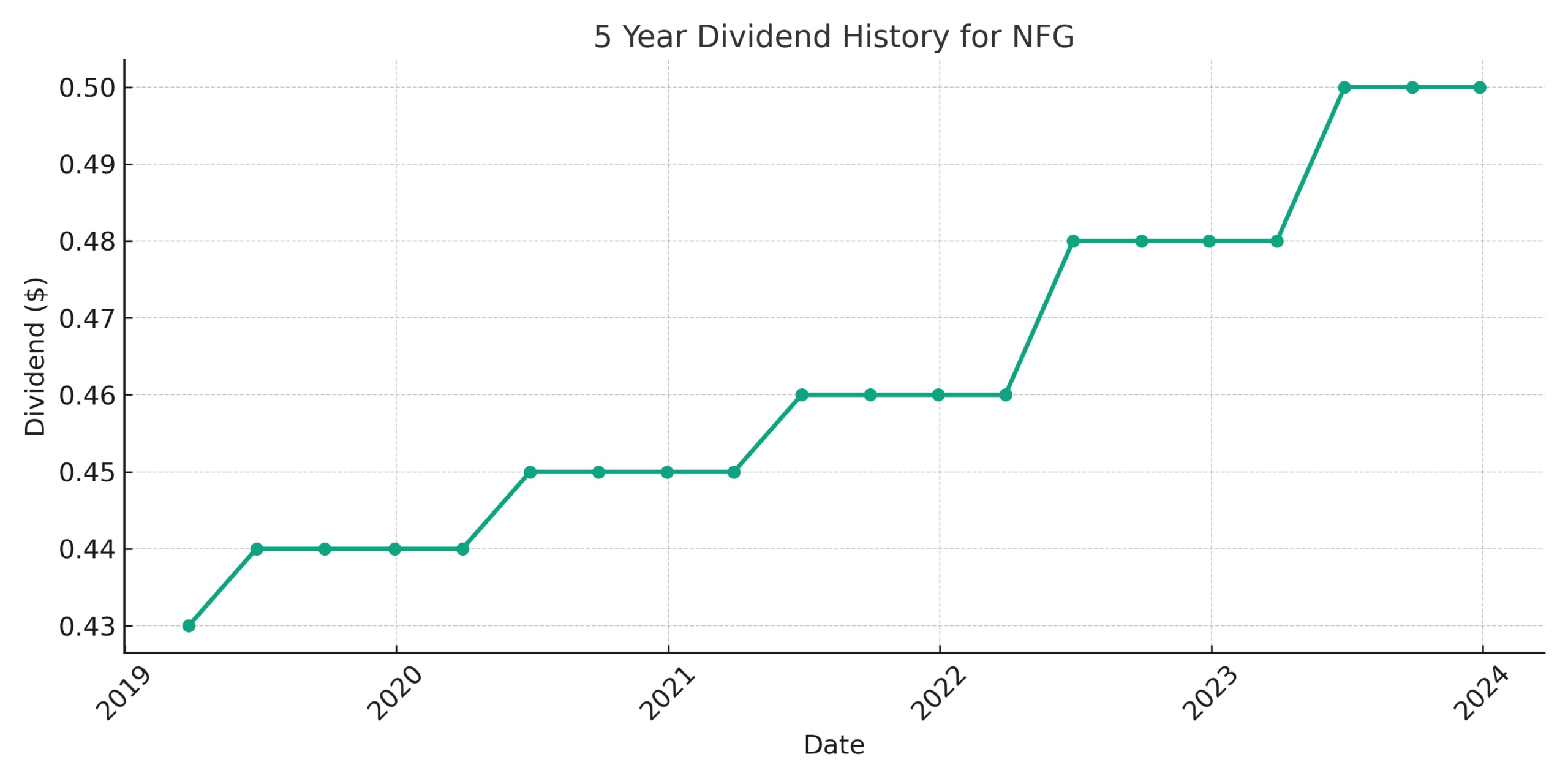

National Fuel Gas Company (NFG) stands as a testament to consistent shareholder return, having increased its dividends for 52 years straight. This achievement is underscored by a considerable dividend yield of 4.14%, which comfortably exceeds the 5-year average yield of 3.49%. The company’s dividend yield remains robust despite a challenging year that saw a 15.20% decline in revenue growth and a 1-year return rate dipping to -16.32%. The payout ratio of 37% suggests that the company maintains a balanced approach to distributing profits and reinvesting in its operations.

The 5-year dividend growth rate for NFG is recorded at 2.45%, indicating a steady increase in dividend payouts over time. This growth is a signal of the company’s commitment to providing value to its shareholders and its ability to do so consistently, even when facing economic headwinds. This conservative dividend growth reflects a company that’s cautious yet dedicated to maintaining its status among the elite group of Dividend Kings. The relatively modest payout ratio compared to the high yield further highlights NFG’s financial prudence and its potential for sustained dividends in the future.

Dividend Value

National Fuel Gas Company (NFG) presents an interesting case for dividend-focused investors, particularly those with an eye for consistency and a penchant for yield. With a laudable track record of increasing dividends for 52 years, the company not only exemplifies stability but also reflects a commitment to shareholder returns, situating it within the venerable ranks of Dividend Kings. The current yield stands at a robust 4.14%, comfortably surpassing the 5-year average yield of 3.49%. This differential suggests that, at current prices, NFG offers a more generous income stream compared to its historical norm.

However, investors might raise an eyebrow at the yield’s upward trajectory, especially when it eclipses the 5-year dividend growth rate of a modest 2.45%. In absence of revenue growth — indicated by a 1-year revenue decline of 15.20% — the elevated yield could signal market skepticism towards the company’s future earnings potential or be a reflection of a broader, sector-wide malaise. Nevertheless, the relatively low payout ratio of 37% could quell some concerns, indicating that the dividend, albeit growing slowly, is not currently at risk and is well-covered by earnings. This juxtaposition of yield against the backdrop of its average paints a picture of a stock that might be currently undervalued, offering a higher income return to those willing to wade into its waters.

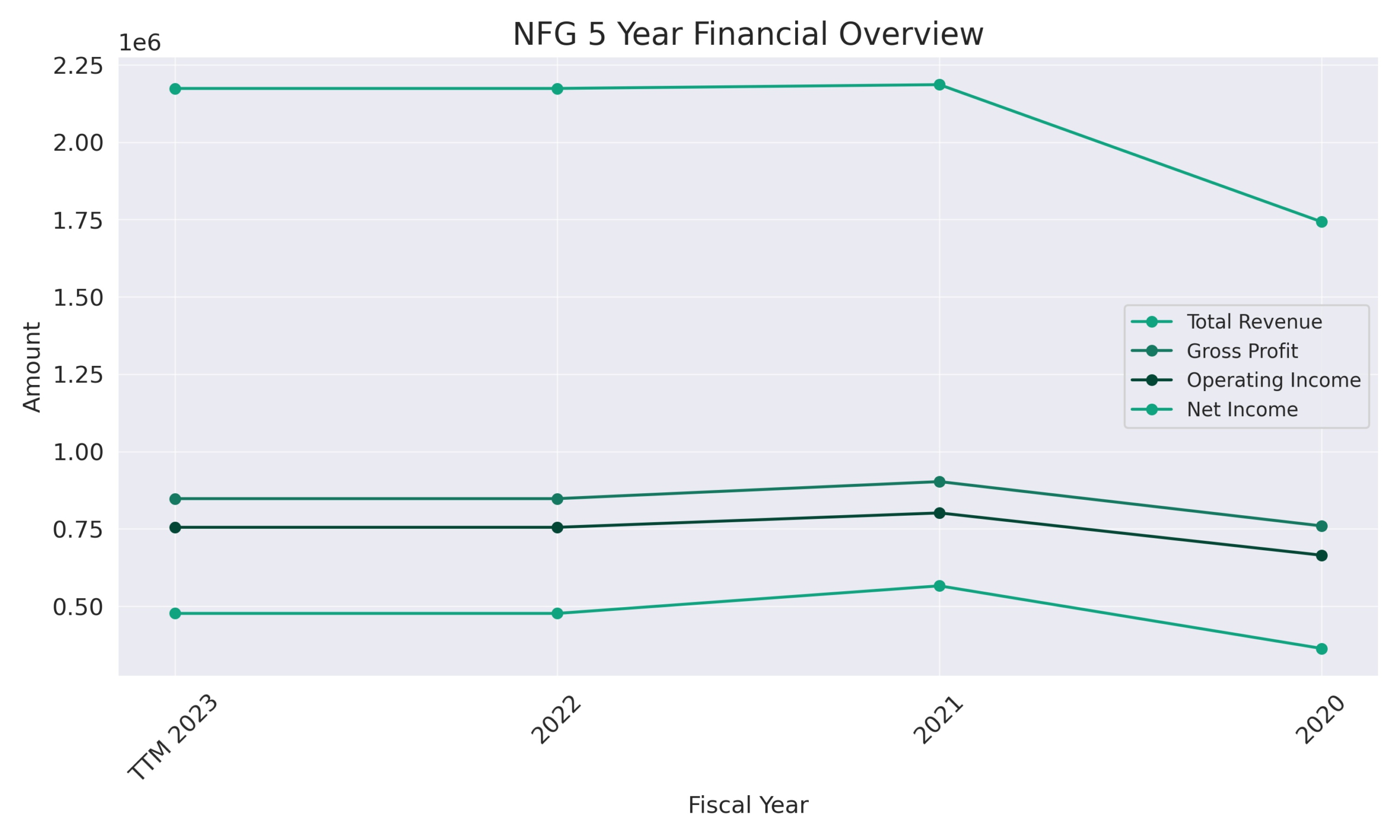

Income statement Analysis

The income statement of the company over the trailing twelve months shows that total revenue stood firm like a steadfast lighthouse at $2,173,771, not budging an inch from the previous year. This immovable figure seems to be playing a stoic game of ‘Red Light, Green Light’ with potential growth prospects. On the flip side, the cost of revenue, at $1,325,924, showed the company’s continued prudence in managing its outlays, an attribute that would make any accountant nod in respectful acknowledgment.

Delving into the operational forte, the company paraded an operating income of $755,147, which if we dare say, could make shareholders dance a little jig of contentment, considering it’s a notch above the operating expenses that were only a whisper at $92,700. Yet, when it comes to non-operating expenses and other income, the numbers did a delicate tango at -$131,886 and $18,138, respectively, hinting at a fiscal discipline that might make even the most austere of financial planners crack a smile. Net income common stockholders pocketed $476,866, a sum not to be scoffed at, unless one’s pockets are already lined with gold. The EPS figures, basic and diluted, stood at $5.20 and $5.17 respectively, shining a light on the company’s ability to turn revenue into profit, a skill as revered in business as a maestro’s in an orchestra.

Balance sheet Analysis

National Fuel Gas Company, known as NFG in the shorthand of the market, has been like the diligent squirrel, steadily growing its stash of assets to $8.28 billion as of the TTM ending September 30, 2023. That’s up from the previous year’s $7.9 billion, suggesting a knack for finding and storing value even when the economic seasons change. This increase in assets comes despite liabilities also growing a bit heftier, climbing up the balance sheet from $5.8 billion in 2022 to $5.3 billion in the TTM period.

Equity, the residual interest in the assets after deducting liabilities, stands at $2.96 billion, which might not be as high as some would dream of but is certainly no pocket change. It’s an increase from $2.08 billion in 2022, indicating that NFG isn’t just hoarding assets like a hermit but is actually increasing the shareholders’ share of the pie. While the working capital might seem like it’s been caught in a downdraft, going negative to $391,884 in the TTM, it’s important to remember that in the world of balance sheets, sometimes it’s the tortoise, slow and steady, that wins the race, not the hare dashing to the bottom line.

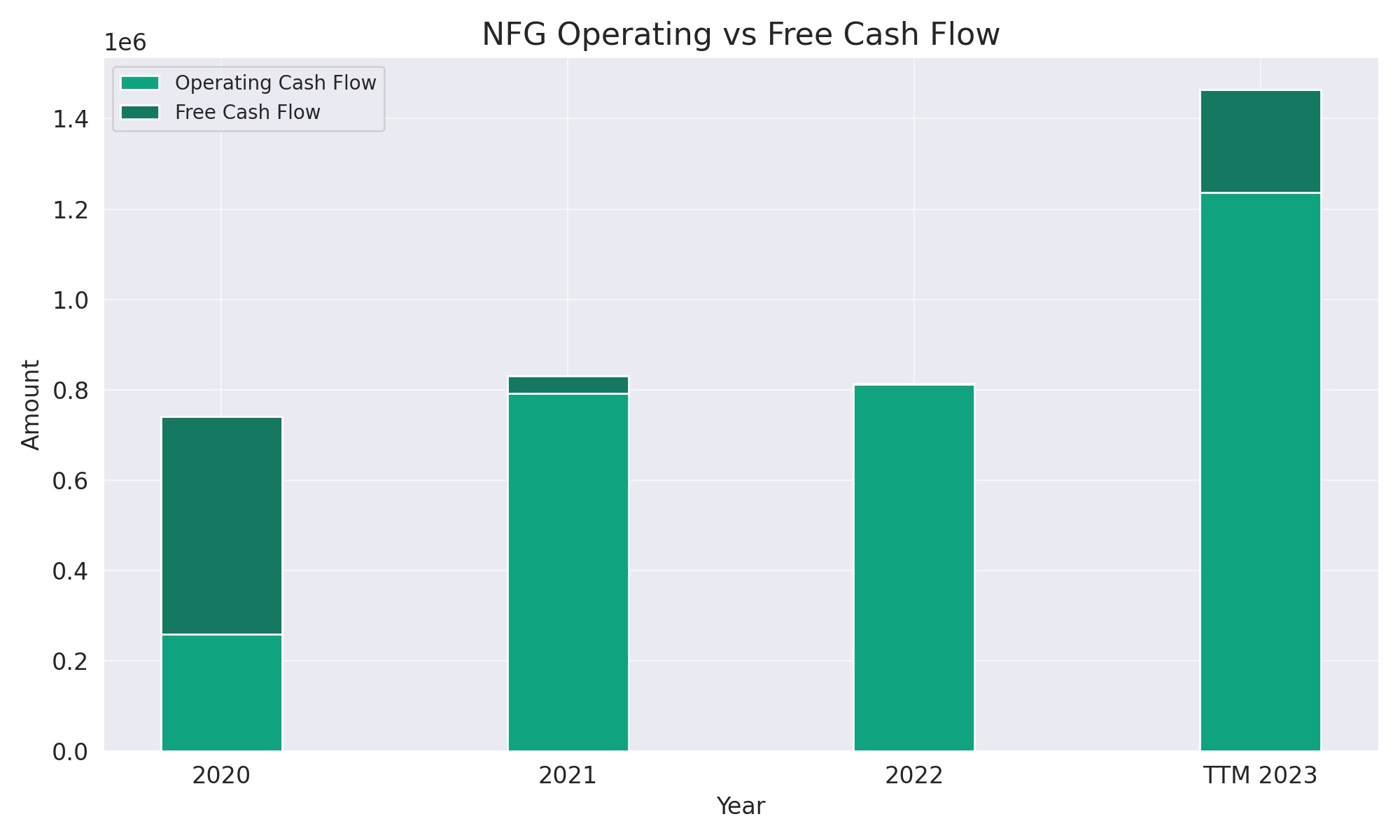

Cash Flow Statement Analysis

National Fuel Gas Company shows a cash flow statement that could make the most poker-faced accountant raise an eyebrow. In the TTM ended September 30, 2023, they’ve generated a robust operating cash flow of $1.24 million, not too shabby for a company that’s been turning valves and counting cubic feet of gas for over a century. It’s a significant climb from the previous year’s $740,809, like finding an unexpected windfall while digging through the couch cushions.

Investing activities, however, have been more of a cash bonfire, with $1.11 million going up in smoke as investments. This figure mirrors the adventurous spirit of a company unafraid to put money into the ground, even if it means waiting with bated breath for a return. Financing activities also saw a cash outflow of $207,000, suggesting that NFG might be tightening the purse strings, perhaps in a bid to play a more conservative game than the high rollers. The ending cash position, sitting at a modest $55,447, would hardly make for a thrilling heist movie climax, but it tells of a company keeping its powder dry for the future.

SWOT Analysis

Competitors

- Exxon Mobil Corporation: A multinational oil and gas corporation, Exxon Mobil is one of the world’s largest publicly traded energy providers and chemical manufacturers, directly competing in the energy market with extensive operations in exploration, production, and selling of oil and natural gas.

- Chevron Corporation: Another leading multinational energy corporation, Chevron engages in every aspect of the oil, natural gas, and geothermal energy industries, including hydrocarbon exploration and production; refining, marketing and transport; chemicals manufacturing and sales; and power generation.

- ConocoPhillips: Focused solely on exploration and production, ConocoPhillips is the world’s largest independent E&P company based on production and proved reserves, competing in the natural gas market through its significant operational footprint.

- Equinor ASA: A Norwegian multinational energy company, Equinor operates in 36 countries and is engaged in the exploration, production, transportation, refining, and marketing of petroleum and petroleum-derived products, as well as other forms of energy, including wind and solar.

- EOG Resources, Inc.: An American company engaged in hydrocarbon exploration, EOG Resources is one of the largest independent (non-integrated) crude oil and natural gas companies in the United States, with a significant production volume of natural gas.